Welcome to Extreme Investor Network, where we provide expert analysis and insights into the world of finance. Today, we are diving into the latest news surrounding Taiwan Semiconductor Manufacturing Co. (TSMC) and its impressive quarterly revenue growth.

According to Bloomberg, TSMC experienced its fastest revenue growth in over a year, signaling a global uptick in AI development and the demand for high-end chips and servers. The company reported a 16% growth in March-quarter sales, surpassing expectations and reaching approximately NT$592.6 billion ($18.5 billion).

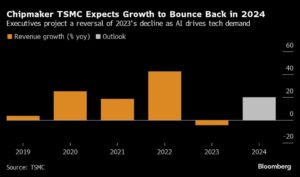

This stellar performance has solidified expectations that TSMC, a key chipmaker for industry giants like Nvidia and Apple, is poised for a strong year ahead. Despite challenges faced during the pandemic, TSMC is projecting revenue growth of at least 20% for 2024 after a slight decline in 2023. The company is also investing heavily in capital expenditure, with plans ranging from $28 billion to $32 billion.

Investors have taken notice of TSMC’s success, with the company’s value more than doubling since a low point in October 2022. The increasing demand for advanced AI chips, alongside TSMC’s strategic expansion plans in the US, Japan, and Germany, has fueled this growth. TSMC’s AI revenue is growing at an impressive rate of 50% annually, highlighting the importance of its role in powering data centers for major tech players like Amazon and Microsoft.

While TSMC’s success is a positive sign for the semiconductor industry as a whole, some caution remains. Concerns linger around the sustainability of current AI chip demand, as well as geopolitical tensions in the Taiwan Strait. The rivalry with Chinese tech giant Huawei and Apple’s challenges in the Chinese market are also factors to consider.

As we eagerly await TSMC’s full earnings report on April 18, it’s clear that the company’s agility and innovation in the chip manufacturing space are key drivers of its success. Stay tuned to Extreme Investor Network for more updates on the latest developments in the finance world.

With expert insights and in-depth analysis, Extreme Investor Network is your go-to source for all things finance. Join us as we navigate the complexities of the market and uncover lucrative investment opportunities. Subscribe now to stay ahead of the curve!