In today’s rapidly evolving markets, one trend that’s hard to ignore is the rise of artificial intelligence (AI). With technology stocks on the rise and the S&P 500 and Nasdaq Composite hitting record levels, it’s clear that AI is a major driving force behind this growth.

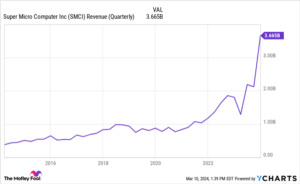

One stock that has caught the attention of many investors is Super Micro Computing (NASDAQ: SMCI). Over the past five years, its shares have surged an impressive 5,830%, with a further 300% gain so far in 2024. What’s even more exciting is that it is not part of the usual “Magnificent Seven” companies that dominate the headlines.

Super Micro plays a crucial role at the intersection of semiconductors and AI, designing integrated systems for IT architecture like storage clusters and server racks. The company has been in high demand due to the increased interest in graphics processing units (GPUs) from companies like Nvidia and Advanced Micro Devices.

With revenue growing over 100% annually and significant momentum propelling its stock, Super Micro is often referred to as a “stealth Nvidia” by Wall Street analysts. However, it’s essential for investors to look beyond the sales acceleration and consider factors like the company’s margin profile, which has been a concern due to aggressive investments in new designs and market share acquisition.

While Super Micro is well-positioned within the AI landscape, its valuation has become increasingly disconnected from fundamentals. Investors need to be cautious and not chase the stock purely based on its inclusion in the S&P 500. Monitoring the company’s performance and waiting for more appropriate valuations may be a wiser move in the long run.

Ultimately, Super Micro Computing presents an interesting opportunity to invest in AI, but it’s important to weigh the risks and potential rewards before diving in. With the AI revolution in full swing, companies like Super Micro are poised to play a significant role, but prudent investors should proceed with caution.

Source link