Title: Two Undervalued Artificial Intelligence Stocks to Consider: Nvidia and Taiwan Semiconductor Manufacturing

SoundHound AI has been red-hot on the stock market in 2024, with stunning gains of 288% so far. Investors have been buying shares of this voice artificial intelligence (AI) solutions provider hand over fist based on the belief that it could become the next big AI play.

The company’s revenue has been growing at an impressive pace, and it also boasts of a solid pipeline that could help it sustain its red-hot growth in the future. What’s more, SoundHound AI stock has got a vote of confidence from AI pioneer Nvidia (NASDAQ: NVDA), which has a small stake in the company. This is a big reason why shares of SoundHound have simply taken off in the past month or so.

However, investors looking to buy an AI stock right now may not be comfortable paying 42 times sales for SoundHound, which is way higher than the tech sector’s average of 7.1. Of course, it may become a key player in the AI market in the long run, but SoundHound AI is currently quite small and far from being profitable. Instead, investors may want to consider two established AI companies that appear to be undervalued: Nvidia and Taiwan Semiconductor Manufacturing.

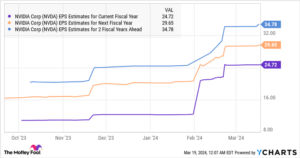

Nvidia, despite trading at 36 times sales, is showing impressive growth figures that make it a good deal for investors. Its revenue in the fourth quarter of fiscal 2024 jumped 265% year over year, and its adjusted earnings grew at a faster pace of 486% year over year. With a revenue guidance of $24 billion for the first quarter of fiscal 2025, Nvidia is on track to more than triple its revenue once again. Analysts have raised their growth estimates, expecting Nvidia’s earnings to nearly triple over the next three fiscal years from fiscal 2024 levels.

Taiwan Semiconductor Manufacturing, the world’s largest foundry company, is trading at 10 times sales and 26 times trailing earnings. TSMC’s dominant position in the foundry space gives it an advantage in the AI chip market, with multiple chipmakers including Nvidia, AMD, and Intel relying on TSMC’s advanced manufacturing processes. With TSMC’s earnings estimates heading higher, investors may want to consider buying this AI stock before it becomes expensive.

In conclusion, while SoundHound AI may be gaining attention in the AI market, investors looking for undervalued AI stocks should consider Nvidia and Taiwan Semiconductor Manufacturing. These established companies show impressive growth potential and may deliver healthy gains in the long run. Don’t miss out on these opportunities before they become too expensive.

Source link