Artificial Intelligence Driving Taiwan Semiconductor Manufacturing Co.’s Stock Rally

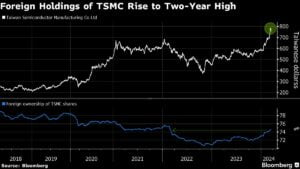

The frenzy surrounding artificial intelligence (AI) is overshadowing geopolitical concerns as Taiwan Semiconductor Manufacturing Co. (TSMC) continues its record-breaking stock rally. Foreign investors have increased their ownership of TSMC to a two-year high, supporting TSMC’s claim that AI will be its primary growth driver this year. With more than a 90% share in manufacturing advanced semiconductors used for AI, TSMC is positioned as a leader in the industry.

The turnaround in TSMC’s stock price last year, following a 27% decline in 2022, coincided with Warren Buffett’s sale of his $5 billion TSMC holdings due to geopolitical tensions surrounding Taiwan. The island’s election of a US-friendly president has further heightened concerns, with Beijing criticizing the new leader as an “instigator of war.”

Despite these geopolitical uncertainties, TSMC remains a key player in the semiconductor industry, with a high concentration of chip manufacturing in Taiwan. TSMC’s dominance in advanced chips and its majority share of the global foundry market set the company up for long-term growth and success.

Despite concerns about its Taiwan-based operations, TSMC is making strides to diversify its manufacturing bases by expanding into Japan, Arizona, and Germany. The chipmaker’s revenue has already seen a significant increase in the first two months of the year, driven by demand from AI applications and growth in key customer Nvidia Corp.

In conclusion, TSMC’s position as a leader in AI and advanced semiconductor manufacturing makes it a fundamental building block for investors looking to capitalize on the AI revolution and the broader semiconductor industry recovery. Geopolitical concerns may linger, but TSMC’s strategic moves to diversify its operations and strong growth prospects make it a compelling investment opportunity in the emerging markets.

For more business news and updates, visit Bloomberg Businessweek.

©2024 Bloomberg L.P.

Source link