Welcome to Extreme Investor Network!

Are you ready to dive into the latest updates on the financial market? Let’s take a look at what’s been happening recently:

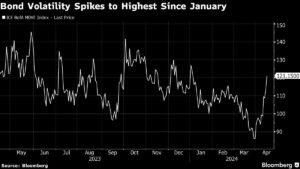

After a bout of volatility, the markets seemed to have found a semblance of calm on Wednesday. Investors shifted their focus to corporate earnings following hawkish remarks from Federal Reserve Chair Jerome Powell, which pushed the dollar and Treasury yields to five-month highs.

In Europe, the Stoxx Europe 600 index had a mixed day with some of the region’s largest companies reporting earnings. London’s benchmark lagged behind, while the pound gained and gilts fell after UK inflation data came in higher than expected. Across the pond, US equity futures dipped slightly after the S&P 500 experienced its third consecutive day of losses. The MSCI Asia Pacific Index also faced pressure as it neared erasing its gains for the year.

Technology stocks faced some headwinds in Europe, with ASML Holding NV seeing a more than 6% drop in its stock price after missing first-quarter order estimates. On the flip side, Adidas AG saw a more than 4% increase after raising its revenue and profit outlook. Luxury sector leader, LVMH, also saw positive movement after releasing reassuring results. Volvo AB reported strong earnings, leading to gains in its stock price.

Amidst all this, Treasury yields remained near 2024 highs, and the dollar held steady after a five-day winning streak. Powell’s comments on inflation signaled a shift in tone, suggesting that it may take more time to reach the central bank’s inflation target. Geopolitical tensions in the Middle East added another layer of uncertainty, with Israel considering a response to the first attack on its soil from Iran.

Our expert, Matete Thulare, head of foreign-exchange execution at Rand Merchant Bank in Johannesburg, noted, “Appetite for risky assets continues to fall as tensions remain in the Middle East and the prospects of a rate cut in the US are decreasing on an almost daily basis.”

Traders who had previously priced in up to six rate cuts in 2024 are now questioning if even a half point of reductions is likely. Market expectations for Fed rate cuts have dropped significantly in the past two weeks, with Powell’s remarks on inflation further influencing these sentiments.

Looking ahead, Asian liquefied natural gas prices surged to their highest level since early January, while oil prices experienced a slight dip. Investors are keeping a close eye on how Israel might respond to Iran’s recent actions. Gold prices, on the other hand, remained near record highs.

Key events to watch this week include Eurozone CPI data, various Fed speakers, and earnings reports from companies like Taiwan Semiconductor. Market participants will also keep an eye on economic indicators like existing home sales and initial jobless claims in the US.

Here are some of the main market movements:

- Stocks:

- The Stoxx Europe 600 rose 0.1%

- S&P 500 futures were little changed

- Nasdaq 100 futures fell 0.1%

- Futures on the Dow Jones Industrial Average were little changed

- The MSCI Asia Pacific Index fell 0.3%

- The MSCI Emerging Markets Index rose 0.2%

- Currencies:

- The Bloomberg Dollar Spot Index fell 0.1%

- The euro was little changed at $1.0625

- The Japanese yen rose 0.1% to 154.55 per dollar

- The offshore yuan rose 0.2% to 7.2515 per dollar

- The British pound rose 0.3% to $1.2460

- Cryptocurrencies:

- Bitcoin rose 0.6% to $63,446.13

- Ether rose 0.3% to $3,079.49

- Bonds:

- The yield on 10-year Treasuries was little changed at 4.66%

- Germany’s 10-year yield was little changed at 2.49%

- Britain’s 10-year yield advanced three basis points to 4.33%

- Commodities:

- Brent crude fell 0.2% to $89.82 a barrel

- Spot gold fell 0.1% to $2,379.87 an ounce

Stay tuned for more updates and expert insights on Extreme Investor Network!