At Extreme Investor Network, we are excited to share the latest updates on Taiwan Semiconductor Manufacturing Co. (TSMC), a key player in the semiconductor industry. TSMC recently announced a better-than-projected revenue outlook, maintaining its plans to invest up to $32 billion in 2024. This news reinforces expectations of sustained growth in AI demand, which is crucial in today’s technology-driven world.

Following its first quarterly profit rise in a year, TSMC reported strong AI demand that fueled growth at Asia’s largest company. As the leading chipmaker for companies like Nvidia Corp. and Apple Inc., TSMC expects revenue of $19.6 billion to $20.4 billion in the upcoming June quarter, surpassing estimates and showcasing the strength of AI demand.

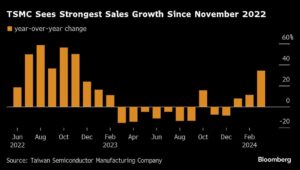

Amid concerns about AI demand sustainability and a potential delay in smartphone recovery, TSMC remains optimistic about its growth prospects. The company’s recent sales growth, fueled by AI chip demand, is offsetting the challenges faced in the smartphone market. Despite revising its expectations for semiconductor market growth in 2024, TSMC is committed to its substantial spending plans for capacity expansion and upgrades this year.

Looking ahead, TSMC anticipates a revenue growth of at least 20% this year as the broader semiconductor market rebounds. The company also announced plans to begin mass production of next-generation 2nm chips by the end of 2025. Additionally, TSMC’s focus on AI revenue growth, which is increasing at a rate of 50% annually, demonstrates its commitment to staying at the forefront of technological innovation.

While uncertainties in the global macroeconomic and geopolitical landscape persist, TSMC remains dedicated to meeting the high demand for AI chips. With a market value increase of $340 billion since October 2022, TSMC continues to be a key player driving the AI development boom. As the industry evolves, TSMC’s proactive approach to meeting future demands positions it as a promising investment for investors looking to capitalize on the AI revolution.

Stay connected with Extreme Investor Network for more updates on TSMC and other investment opportunities in the ever-evolving world of finance. Join us as we navigate the exciting realm of finance and technology together.