**Yen Rebounds Sharply After Dropping to 34-Year Low**

The yen recently experienced a significant rebound after dropping to its lowest point in 34 years, sparking speculation that authorities may have intervened. This sudden shift in the currency markets has caught the attention of investors worldwide, with European and US stock futures also rising in response to the positive sentiment in Asia.

At Extreme Investor Network, we pride ourselves on providing unique and valuable insights into the world of finance. The recent volatility in the yen, coupled with the rise in stock futures, presents an intriguing opportunity for investors to navigate through the changing market dynamics.

**Asia’s Rally and Market Sentiment**

Chinese stocks led the rally in Asia, signaling a revival in the market amidst a return of foreign investments and improved earnings. The Hang Seng Index saw gains, with a particular focus on property shares following a significant development by major developer CIFI Holdings Group Co. This surge in market activity highlights the shifting landscape of global investments and the impact of key economic indicators.

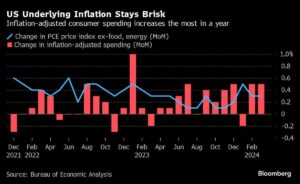

**Federal Reserve Policy Meeting and Market Expectations**

Traders are closely monitoring the upcoming Federal Reserve policy meeting, scheduled for Wednesday. The recent rise in inflation rates has spurred speculations about the Fed’s stance on interest rates and monetary policy. Our experts at Extreme Investor Network anticipate potential shifts in the post-meeting statement and Chair Jerome Powell’s press conference, which could impact market sentiments moving forward.

**Market Trends and Investment Strategies**

As market dynamics evolve, it is essential for investors to stay informed about key events and economic indicators shaping global financial markets. With a comprehensive outlook on stocks, currencies, cryptocurrencies, bonds, and commodities, our team at Extreme Investor Network provides expert analysis and strategic insights to help investors make informed decisions.

Join us as we delve deeper into the latest market trends, investment opportunities, and economic developments to empower you with the knowledge needed to navigate the complex world of finance successfully.

Stay tuned for more updates and expert insights from Extreme Investor Network, your trusted source for innovative financial analysis and valuable investment strategies.