It’s been an interesting week so far in the world of gold prices and central banks making use of their gold reserves. For those asking if they should buy gold, two events this week provide further arguments on the benefits of holding the precious metal.

There is little doubt that central banks, notably the U.S. Federal Reserve, are going to have a mess to clean up after the catastrophe they have created in markets. Just about everything is jittery – equities, bonds, housing …etc.

Even gold and silver prices have been on a roller coaster ride from one day to the next.

After last week’s Fed meeting on Wednesday equity markets rallied but then declined. On Thursday and Friday, fear took hold – namely fear of recession/stagflation.

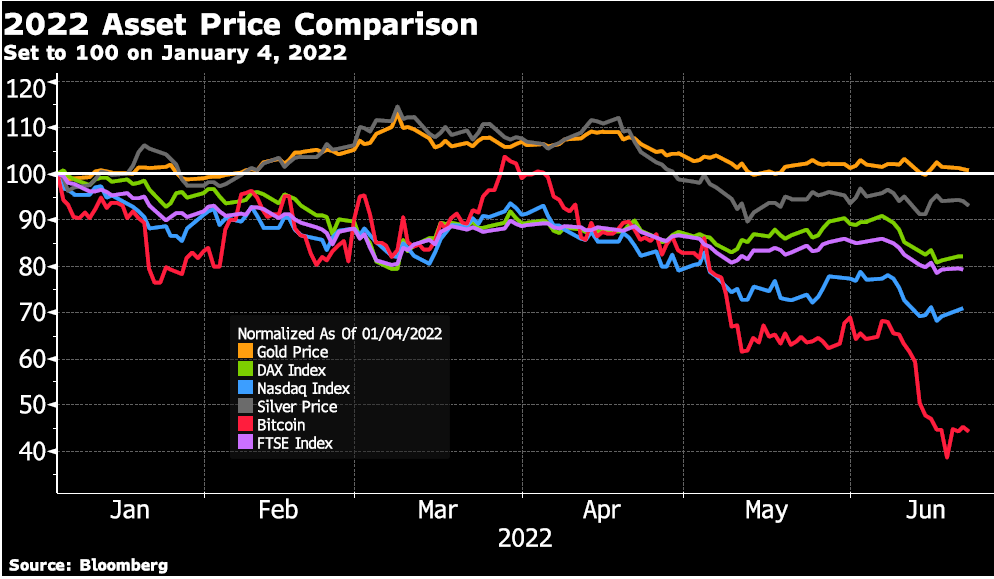

The chart below shows a comparison of gold, silver, select equity indices, and bitcoin.

During this time of market turmoil gold and silver have done their job of holding their value!

Take note of the sharp decline in Bitcoin once touted by many as the ‘new gold’ … in this instance Bitcoin is the largest decliner, but in US dollar terms gold has not declined at all!

Two other topics of interest made news this week:

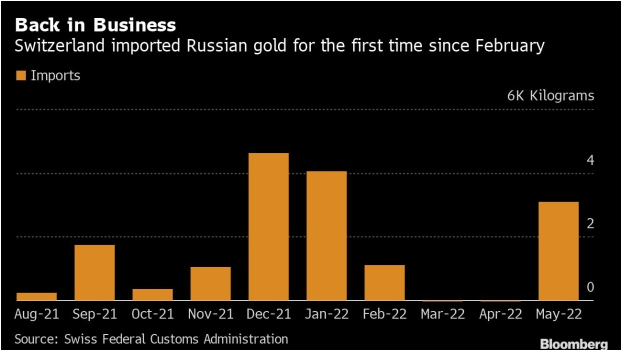

Firstly $100,000,000 of Russian gold was moved into Switzerland and, secondly the newly released report from the Bank of International Settlements (BIS) on the future of the monetary system.

Is Russian gold shining again?

The Swiss Federal Customs Administration reported that it imported over 3 tons of gold from Russia in May. This is the first time that Switzerland has imported gold from Russia since the war broke out in February.

This could be a sign that the perception of Russia is changing as most refiners would not accept Russia’s gold after sanctions were implemented in late February.

Back then LBMA (London Bullion Market Association) removed Russia’s fabricators from its accredited list. This put a de facto ban on newly mined Russian gold.

However, previously mined gold was not prohibited from being further processed by other refiners. But some refiners were hesitant to do so.

Russia has a big impact on the gold market, it is the second-largest gold-producing country (following China) and its central bank holds the 5th largest gold reserves. Russia’s central bank holds 2299 tonnes of gold. For more see our post from December 9 Russia: A Prominent Player in the Global Gold Market

The physical move of gold from Russia to Switzerland does not mean that the Russian Central Bank is selling its gold.

More likely is that this gold is loan guarantee collateral. Obviously, no one but the Russian central bank knows for certain what is happening to this physical gold.

But it does once again give us a chance to remind everyone that counterparty risk is so important.

Russia may have willingly moved some of its refined gold to Switzerland because without doing so that physical gold cannot become the collateral for borrowing money or maybe even the basis of the gold sale.

No one would be willing to lend Russia money against that gold if the physical gold remained in Russia because: if you don’t hold it then you don’t own it.

Here is a hypothetical example to illustrate the workings of a loan for which this recently shipped gold serves as collateral. Assume that Russia wants to borrow $100,000,000 from India to pay for computer chips made in Singapore.

India might be willing to lend money to Russia despite the Ukraine war. However, India definitely knows Russia cannot be trusted to repay just because Russia previously agreed to pay.

Said another way, Russia is not considered a reliable counterparty, especially regarding assets contained within its own Russian borders. Furthermore, after a loan default, no Russian judge would dare rule India had a valid claim unless President Putin said so publicly. Hence India cannot rely upon the Russian legal system to protect India’s interests as a lender to Russia.

And India knows that its own Indian army is not strong enough to force its way into Russia. Then collect $100,000,000 of assets, and then leave Russia if the collection is needed following a loan default.

So, a peaceful collateral arrangement is necessary where the physical gold is moved to where India can seize it if the loan goes bad. Such holding and owning agreements are needed before any loan is made.

Without India being comfortable that the loan principal will be repaid by either cash from Russia or by India seizing the tonnes of gold, no loan would ever be advanced. So what is the solution?

The solution was that gold collateral for such a loan needed to rest with a counterparty acceptable to India.

India knows that Switzerland will hand over Russia’s gold once it is clear that Russia cannot (or will not) repay India any other way.

From the Indian lender perspective, Switzerland is an acceptable counterparty for physical gold whilst Russia is clearly not. This means the gold guarantee of a $200,000,000 loan must be held in Switzerland instead of Russia.

On the other hand, Russia views Switzerland as a better counterparty than India for holding its gold because Switzerland has zero incentive to seize gold that does not belong to it – especially from Russia.

Notably, the Russians would never choose America as a counterparty for this gold loan. Since America is already busy seizing whatever Russian assets it can find.