U.S. Treasury yields rose on Monday to begin August as investors continued to assess the prospects for an economic recession.

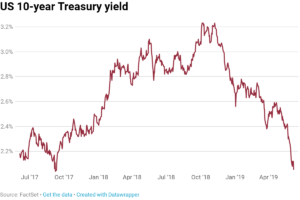

At around 6:22 a.m. ET the yield on the benchmark 10-year Treasury note was up at 2.658% while the yield on the 30-year Treasury bond climbed to 3.02%. Yields move inversely to prices.

The 2-year yield also gained to just above 2.9%, meaning the closely watched 2-year/10-year yield curve remains inverted, a situation often interpreted as a sign of impending recession.

Wall Street is coming off its strongest month since 2020 as longer-term interest rates moderated slightly and investors found a relief rally after months of deepening pessimism, with corporate earnings offering some reprieve.

Data releases on Monday will include July’s manufacturing PMI (purchasing managers’ index), due at 10 a.m. ET.

The big data point this week will be Friday’s nonfarm payrolls report from the Bureau of Labor Statistics, which will give more insight into the strong labor market.

So far this year, the solid growth of jobs has prompted economists to say the United States is currently not in a recession, even with two consecutive quarters of GDP contraction.