Welcome to Extreme Investor Network, where we provide you with the latest updates and insights in the world of finance and investing. Today, we are discussing the recent developments at Super Micro Computer Inc. that have led to a significant drop in their stock price.

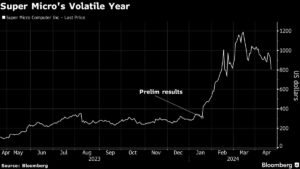

Super Micro Computer Inc. recently announced the date of its third-quarter results, but did not provide any pre-announcement of the results. This lack of positive news caused the stock to plummet by as much as 15%, marking its biggest one-day drop since February 23. The stock is currently trading at its lowest level since February. Despite this decline, shares of Super Micro Computer Inc. are still up over 180% for the year, making it a favorite play on artificial intelligence.

Wells Fargo Securities has noted that the absence of a positive preannouncement from Super Micro Computer Inc. is seen as a negative sign, along with an important AI datapoint. The firm has an equal weight rating on the stock, highlighting the uncertainty surrounding the company’s upcoming results.

The results of Super Micro Computer Inc.’s third quarter will be released on April 30. In January, the company had issued strong preliminary financial results, which led to a significant rally in the stock throughout 2024. The stock’s impressive performance resulted in it being added to the S&P 500 index in March.

On a broader scale, tech stocks are facing pressure on Friday, with geopolitical risks contributing to the Nasdaq 100 Index falling by 0.9%. Other AI stocks such as Nvidia Corp and Dell Technologies Inc. have also experienced declines, reflecting the overall sentiment in the tech sector.

Stay tuned to Extreme Investor Network for more updates and analysis on the latest trends in the finance and investing world. Make sure to subscribe to our newsletter to receive exclusive content and actionable insights to help you make informed investment decisions.