At Extreme Investor Network, we pride ourselves on providing unique insights and valuable information to help investors make informed decisions. Today, we are delving into the investment moves of renowned investor Michael Burry, known for his depiction in the book and movie “The Big Short.”

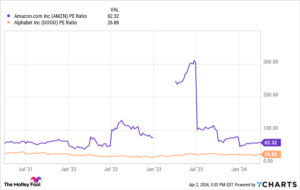

In the fourth quarter of 2023, Burry’s Scion Asset Management surprised many value-investing followers by adding positions in tech giants Amazon (NASDAQ: AMZN) and Alphabet (NASDAQ: GOOG) to its portfolio. These “Magnificent Seven” growth stocks have typically been overlooked by value investors due to their high earnings multiples. Despite this, they now make up 10% of Burry’s stock portfolio.

So why did Burry decide to invest in Amazon and Alphabet?

Amazon, despite its seemingly overvalued status with a price-to-earnings ratio (P/E) of 62, has been steadily increasing its operating margin. The company’s potential for profit has become more evident, especially as its high-margin divisions such as Amazon Web Services (AWS) and advertising show strong growth. With anticipated improvements in profit margins in 2024, Amazon’s investment potential becomes more compelling.

The other addition to Burry’s portfolio, Alphabet, faces some negative narratives despite its promising prospects. The tech giant, with its dominant position in search and growing businesses in YouTube and Google Cloud, has shown resilience in the face of competition. With the potential for continued growth and market dominance, Alphabet remains an attractive investment option.

While it is beneficial to analyze the portfolio holdings of successful investors like Burry, it is important not to blindly follow their moves. Each investor has their own unique investment thesis, and copying their decisions without understanding the rationale can be risky. Instead, it is advisable to build a portfolio based on stocks you believe in, rather than those favored by others.

At Extreme Investor Network, we aim to provide comprehensive insights and expert analysis to help investors navigate the complex world of finance. Stay tuned for more exclusive content and investment advice to help you achieve your financial goals.