At Extreme Investor Network, we are always on the lookout for exciting developments in the world of finance. Recently, Dow Jones giant Johnson & Johnson (JNJ) made headlines with its announcement to acquire Shockwave Medical (SWAV) for a staggering $13.1 billion, or $335 a share. This move sent shockwaves through the market, causing both stocks to rise slightly early on Friday.

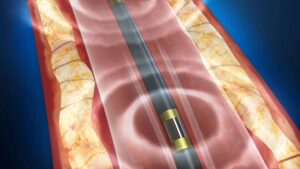

Shockwave Medical, a leader in intravascular lithotripsy, has been making waves with its innovative approach to cracking hardened calcium in blood vessel walls. This acquisition by J&J is set to boost the company’s position in cardiovascular intervention and accelerate its shift into higher-growth markets.

The stock market has been abuzz with takeover speculation, leading to a 68% surge in SWAV stock to 319.99 as of April 4, 2024. Meanwhile, JNJ stock saw a slight dip of 2.7%. Investors are eagerly anticipating the closing of the all-cash deal in mid-2024, pending regulatory approval.

For more stock market updates and insights, be sure to follow Ed Carson on Threads at @edcarson1971 and X/Twitter at @IBD_ECarson.

If you’re looking for more valuable information and tools to enhance your investing journey, check out some of our related articles:

– Why This IBD Tool Simplifies The Search For Top Stocks

– Best Growth Stocks To Buy And Watch

– IBD Digital: Unlock IBD’s Premium Stock Lists, Tools And Analysis Today

Stay tuned for more exciting news and updates from Extreme Investor Network!