Welcome to Extreme Investor Network

In a rapidly changing financial landscape, the role of central banks is evolving. Joachim Nagel, president of the Bundesbank and a member of the European Central Bank (ECB), emphasizes the importance of central banks embracing technological innovation, specifically central bank digital currencies (CBDCs), to remain relevant in the future. At Extreme Investor Network, we understand the significance of staying ahead of the curve when it comes to blockchain and cryptocurrency trends.

Nagel stresses the need for central banks to adapt their business models and address changes in the payment landscape to stay competitive. To survive in this digital era, central banks must explore new possibilities and leverage technology like blockchain to facilitate the adoption of CBDCs, enhancing the efficiency, security, and transparency of financial transactions.

Amid uncertainties surrounding Central Banks, Nagel acknowledges the skepticism stemming from technological advancements and shifting customer preferences. He underscores the urgency for central banks to accelerate their adaptation to these changes, including embracing CBDCs as a strategic move.

Potential Benefits of CBDCs: The implementation of CBDCs offers numerous advantages for businesses and consumers alike. Customers stand to benefit from a secure, fast, and reliable European payment system applicable throughout the eurozone. For merchants, increased competition in the payments industry and swift settlements akin to cash transactions can streamline business operations.

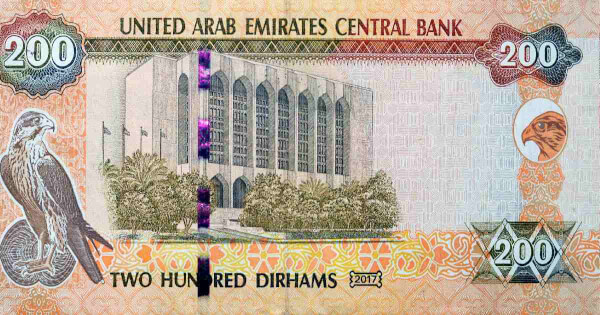

Image source: Shutterstock

. . .

Stay Updated with Our Latest Crypto Insights

By reshaping traditional financial models and harnessing the power of CBDCs, central banks can position themselves for long-term relevance and efficiency in an increasingly digital economy. Join us at Extreme Investor Network for cutting-edge insights on the evolving world of crypto and blockchain technology.

Let’s explore the future of finance together!