The bottom is in.

As everyone knows… the Fed has saved the day again!

On Tuesday, Fed Chair Jerome Powell announced that the Fed is NOT going to raise rates anymore. It’s not going to shrink their balance sheet either. And best of all… inflation which entered the financial system for the first time in 40 years… is actually disappearing and will soon be gone!

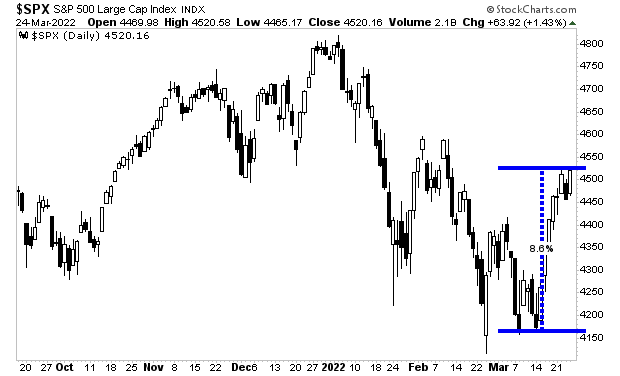

That’s what stocks think, isn’t it? After all, they’ve rallied over 8% in a single week.

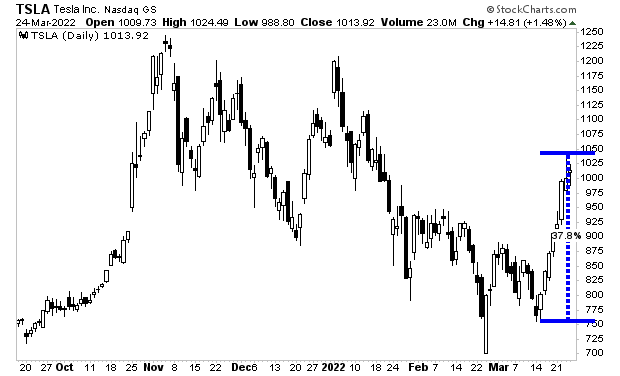

Heck, Tesla (TSLA) is up over 35% in one week’s time!

Oh wait… the Fed didn’t say any of that.

In fact, Jerome Powell said the following on Tuesday:

1) Inflation is MUCH too high.

2) If the Fed finds that raising rates by 0.25% is not enough, it will begin raising by 0.5% at every Fed meeting.

3) If the Fed finds that it is not curbing inflation adequately, it is willing to overshoot to the upside with rate hikes.

So, the Fed is going to be a LOT MORE aggressive than people think. If anything, it’s warning the markets that it’s going to have to raise rates a LOT and quite QUICKLY.

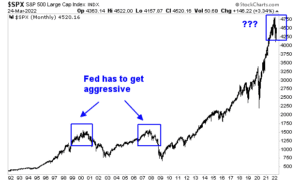

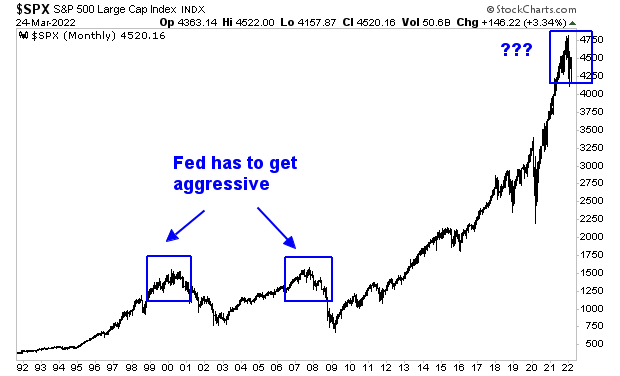

Here’s what happened the last two times the Fed did this. I’m sure the third time’s the charm!

If you believe the Fed will somehow be able to stop inflation without blowing up the markets, please stop reading now.