Far and away the biggest financial story on Tuesday afternoon is the wipeout in Netflix (NFLX) shares. The stock had already lost an eye-watering 50% of its value in half a year’s time, but it wasn’t finished crashing. The stock is down another 25% after hours.

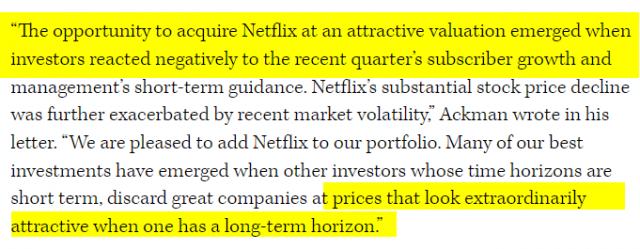

I vaguely remembered that during the last quarter, NFLX also got hit hard and that Bill Ackman had acquired a huge stake in it since it was “on-sale”. I did a little digging, and my brain didn’t lie to me:

Now obviously this investment has worked out fairly horribly for Ackman and his Pershing Square investors, but what must make this extra painful is how they funded the acquisition. Read on from a story published shortly after he did the deed in January 2022:

Now I don’t know the particulars of the “interest rate hedge“, but it’s quite clear from their description that whatever the investment was had been thriving since interest rates had been rising, and if interest rates kept rising, then the investment would likewise keep appreciating in value.

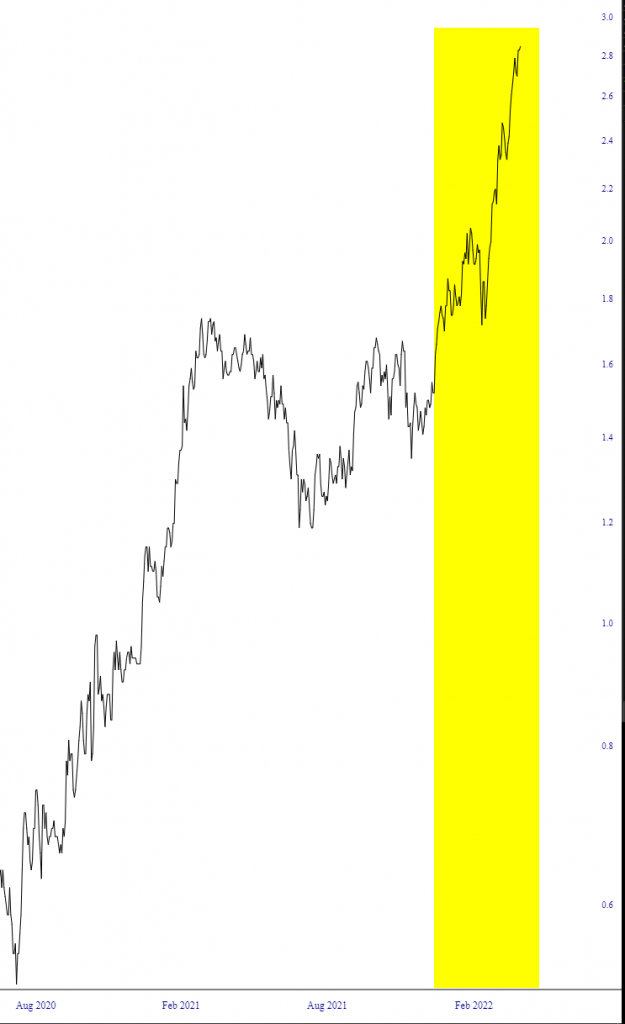

I’m not sure if you’ve noticed, but interest rates have been more than a little frisky lately. I’ve tinted the portion of the rise in rates that Ackman missed by dumping his position

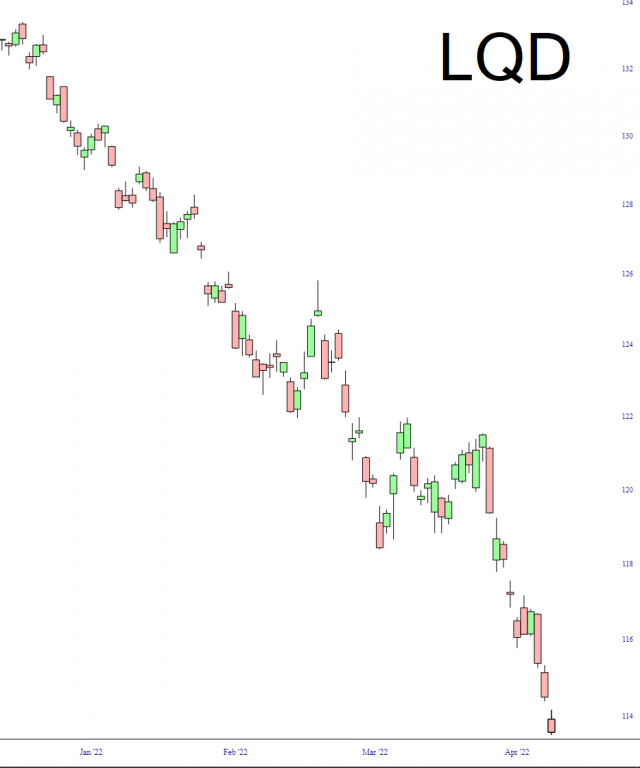

Again, I don’t know the particulars of their hedge, but just about any interest-sensitive financial instrument has been falling virtually every day this year with few exceptions, suggesting to me that whatever ten-figure “interest rate hedge” they had on would have been screaming higher in value for the past three months since they ditched it. The opportunity cost, I suspect, is probably hundreds of millions of dollars.

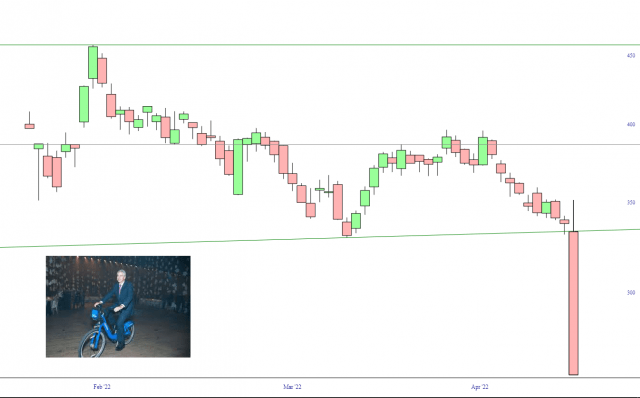

So how did Netflix work out? Well, he bought 3.1 million shares, and although I’m not sure what price they paid, let’s be kind and assume it was $400, which takes into account the wipeout the stock had in January. Allow me to update you on the progress of the stock since then. For a couple of days, Ackman looked like a genius as NFLX started to heal itself, but that didn’t last.

My back-of-the-envelope calculation is that they’re probably down about $400 million on their NFLX purchase which, combined with the foregone profits of dumping the interest rate hedge to fund it, likely adds up to a figure well north of half a billion bucks.

One more tidbit from last January…………

I guess the management committee at Pershing is unexpectedly looking at a REALLY long-term horizon at this point.