Welcome to Extreme Investor Network: Your Source for Expert Finance Advice

As we delve into the intricate world of finance, one thing remains certain: short-term volatility on Wall Street. Over the years, Wall Street’s major stock indexes have witnessed fluctuations between bear and bull markets, adding to the thrill of investing.

During uncertain times, both professional and retail investors often seek refuge in industry-leading stocks known as the “Magnificent Seven.” These companies have proved their worth amidst market turmoil and continue to attract investors seeking stability and growth in their portfolios.

The “Magnificent Seven” – Leading the Way in Finance

The Magnificent Seven represent the largest and most influential publicly traded companies, dominating the market with their performance and strategic positioning. As of April 5, 2024, these seven titans are:

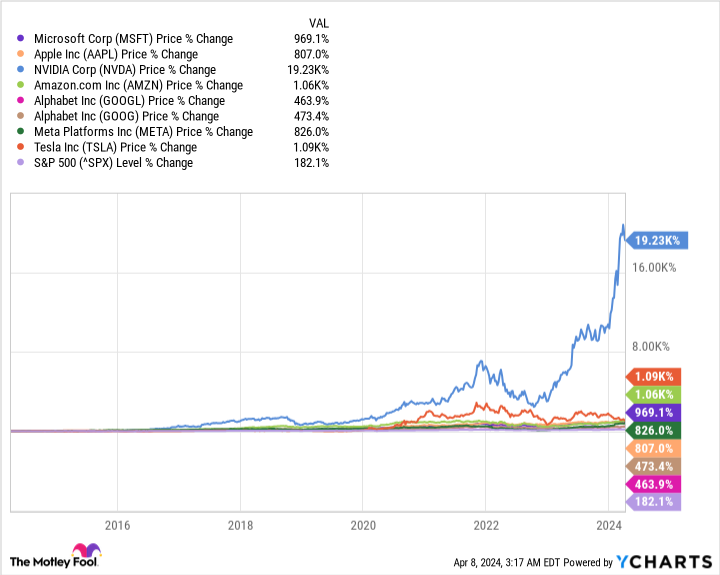

What sets these companies apart is their exceptional track record of growth. While the benchmark S&P 500 gained a respectable 182% over the past decade, Nvidia’s stock soared by a staggering 19,230%, with Amazon, Tesla, and Alphabet not far behind. These companies have demonstrated their ability to outperform and maintain their competitive edge.

Investors flock to these companies not just for their performance but also for their competitive advantages. Microsoft, Apple, Nvidia, Amazon, Alphabet, Meta Platforms, and Tesla each have unique strengths and market dominance that set them apart from the competition.

But despite their remarkable success, billionaire investors have started divesting from most of the Magnificent Seven stocks. During the last quarter, prominent investors reduced their holdings in companies like Nvidia, Microsoft, Alphabet, Meta Platforms, Apple, and Tesla, except for one – Amazon.

Why are billionaires increasing their stakes in Amazon while shedding other Magnificent Seven stocks? Amazon’s ancillary segments like AWS, advertising services, and subscription services are driving growth and generating significant cash flow for the company.

The appeal of these high-growth segments, coupled with Amazon’s historically low valuation, makes it a compelling investment opportunity for billionaires and investors alike.

Invest with Confidence: Extreme Investor Network

At Extreme Investor Network, we provide expert advice on navigating the complex world of finance. Our unique insights and in-depth analysis set us apart as your go-to source for all things investment-related. Join us and unlock the potential for wealth creation and financial success.

Stay tuned for more updates and exclusive content on the latest trends and opportunities in the financial markets.