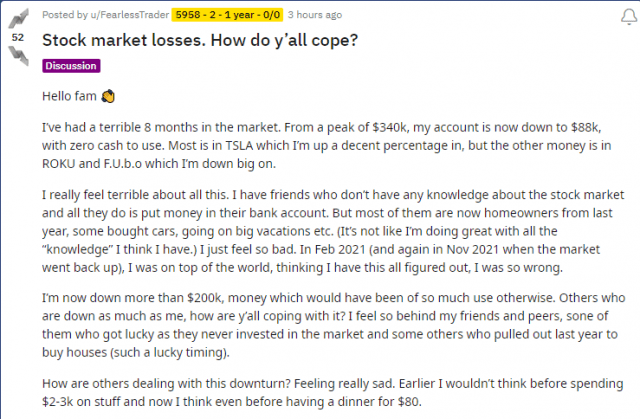

Let us begin with this post from an individual over in the land of wallstreetbets who is bemoaning the fact his $340,000 trading account has been beaten down to $88,000 (a 75% drop) due to picking up such gems as TSLA and ROKU. As you will see, he wants to know how other fellow “traders” deal with such sad feelings. Take a minute to read this:

Now, a true act of tough love would basically say, “I’m sorry you had those losses. Please extract that $88,000, stop trading, and know you’ve got tons of time left to put your life in order. Focus on good mental health and stop harming yourself with trading.“

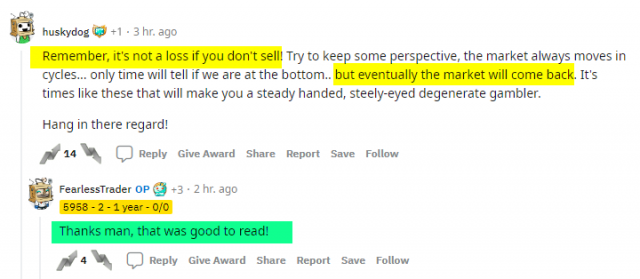

Of course, since this is reddit’s WSB forum – – a venue for hopeless gambling addicts and self-imagined trading geniuses, no such advice was forthcoming. Instead, you had the likes of this……….

Yes, you read that right. The respondent just said two of the stupidest, most cliché things imaginable:

- It isn’t a loss until you sell;

- The market will eventually come back.

That second item is just plain insanity. Nowhere is in written, either on heaven or Earth, that all prices return to their point of origin at some point. Some people paid $1,243/share for Tesla only months ago. Can they rest assured that at some point, a year from now, or a decade, or even a hundred years from now, that it’ll get there again? No!

Is it possible? Yes. It is assured? No, no, no!

As for the first point, that there’s no loss until you sell. On this, I absolutely agree. If you’re a tax authority. But otherwise, good GOD, people, the asset has DROPPED in price. You have a loss. Mark-to-market is a reality with every passing second of the day.

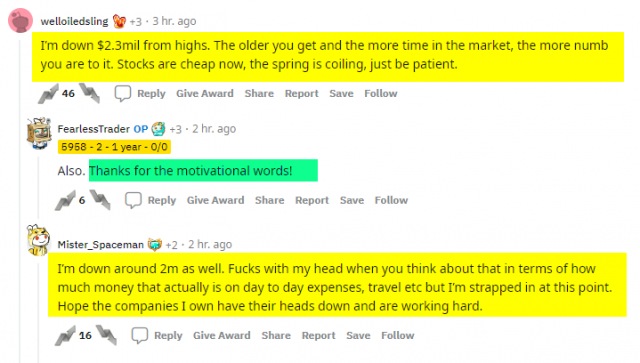

Of course, that wasn’t the only “advice” offered……..

OK, so in this instance, perhaps to help this poor chap feel better about his $200,000+ loss, these two guys stated they’ve lost over TEN TIMES that amount and are still hanging in there like good bag holders. Let’s examine a few of the elements of this interaction:

- “….…the more numb you are to it”: This sounds like an excerpt from a Gamblers Anonymous meeting

- “Stocks are cheap now” – No, they’re not! Their prices have dropped, yes, but that doesn’t make them “cheap“. They are still exceptionally expensive by any objective measure.

- “The spring is coiling” – Nice metaphor, but it doesn’t change the reality. There’s no spring, and even if there was, it isn’t “coiling.” It makes for a nice visual image to seduce yourself into anticipating the orgiastic release of tension, but it ain’t gonna happen. Ask the shareholders of Virgin Galactic how their coiled springs are doing.

- “Hope the companies I own have their heads down and are working hard” – I can assure you, the personnel at these companies do have their heads down, but not for the reasons you hope. The rank-and-file employees there are completely bummed that their equity has lost so much value. They were counting on it to buy a house, have a nice retirement, or do any of the other things that fat employee stock options and RSUs can provide. As it is, that terrific incentive has vanished, and instead of “working hard“, the personnel at the given firm are probably leaving the office at 5:00 p.m. with atomic clock accuracy.

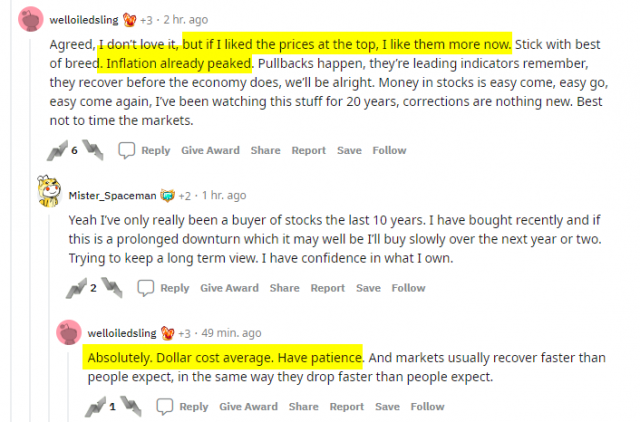

One more………

Okay, let’s pluck through these final three:

- “If I liked prices at the top, I like them more now” – That makes absolutely no sense. You aren’t dealing with a commodity that has a fixed value. In other words, if you were purchasing jet fuel for your airline at a given price, and the price dropped by half, it makes all the sense in the world to cheerfully buy more fuel at the cheaper price. You get the same benefit, but you’re paying less. In the case of paying for an asset like corporate equity, there’s no such comparison. In fact, the old saying “don’t throw good money after bad” is based on the precept that something whose price is plunging is certainly acting that way for a reason.

- “Inflation [has] already peaked” – says who? Biden? Paul Krugman? God almighty?

- “Dollar cost average. Have patience.” – This is amateur hour, bush league type stuff. Buying more of stock XYZ at cheaper and cheaper prices, simply to assuage the pain you’ve felt by screwing up and buying it earlier at higher prices, is unworthy of an investor older than, say, an elementary school student.

For equity bears, the psychological zeitgeist of the dialog above is tremendously helpful, because it helps create the slow, grinding, bounces-now-and-then stock market which makes for a fantastic shorting environment.

For people like the original poster, however, who is coming to his peers, hat in hand, hoping to get some sage wisdom on how to deal with his financial woes, the counsel they are offering here will merely be a psychic salve as his 75% loss metastasizes into a 95% one.