Are you tired of waiting in long lines and going through traditional metal detector security at events? Imagine walking into a venue without emptying your pockets and being scanned in a single-file line. Thanks to Evolv Technologies (NASDAQ: EVLV) and their innovative AI technology, this is now a reality.

Evolv Technologies designs and sells scanners that use artificial intelligence to detect guns and other weapons based on shape and other unique characteristics. This technology not only enhances security but also eliminates the need for patrons to wait in long lines. Wallets and keys won’t set off the alarm like they do with metal detectors, making the process quicker and less intrusive.

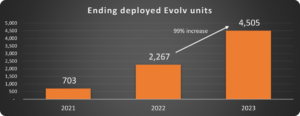

As an investor, you might be wondering if Evolv stock is a buy. The company is experiencing rapid growth in customer numbers, with significant adoption by schools, hospitals, professional sports teams, and more. Revenue has soared due to this growing adoption, and the company reported an impressive 120% annual recurring revenue growth in 2023, reaching $75 million.

While Evolv is still a relatively small company with a market cap of $700 million and is not yet profitable, it is in its high-growth phase. The stock trades at a reasonable price-to-sales ratio of 9, making it an attractive option for investors looking to add a speculative position to their portfolio.

Investing in Evolv Technologies provides exposure to a technology that is both innovative and necessary in today’s security-conscious world. As part of a comprehensive security plan, Evolv’s scanners offer a valuable tool for venues looking to enhance safety for patrons. With the increasing adoption of AI technology in security measures, Evolv is poised for continued growth and success.

For more insights on investing opportunities like Evolv Technologies, be sure to check out our analyst team’s top stock picks in Motley Fool Stock Advisor. With a proven track record of nearly tripling the market, their recommendations are worth considering for your investment portfolio. Don’t miss out on the next big opportunity – explore the 10 best stocks to buy right now with Motley Fool Stock Advisor.

Invest in the future of security with Evolv Technologies and stay ahead of the curve with Extreme Investor Network. Join us in exploring innovative investment opportunities that are shaping the landscape of tomorrow.