Have you ever wondered how the concept of cryptocurrencies came to be? In 1996, the US government released a white paper titled “How to make a mint: the cryptography of anonymous electronic cash” from the National Security Agency Office of Information Security Research and Technology. This document essentially outlined how a government agency could create something similar to Bitcoin or another cryptocurrency.

This white paper, released during the early stages of the dot.com bubble, discussed the potential for creating a cashless society using electronic cash. The document highlighted the importance of electronic payment systems in the growing age of the Internet and electronic commerce. It discussed the features of electronic cash, such as user anonymity and payment untraceability, and how these could be achieved using digital signatures and public key cryptography.

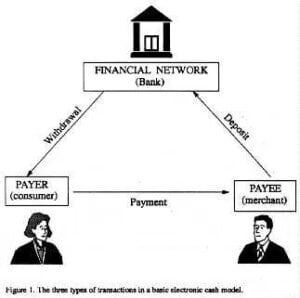

The document discussed various electronic cash protocols, such as untraceable online electronic payments and offline cash transactions, as well as the concept of a crypto wallet for storing electronic coins offline securely. It also touched on the challenges of maintaining anonymity while preventing abuse and multiple spending in the system.

Furthermore, the white paper explored the role of observers in tracing transactions and the need to address issues like tax evasion, money laundering, and other crimes that could arise in an anonymous electronic payment system. It emphasized the importance of balancing anonymity with security and the risks associated with maintaining high levels of anonymity.

This document, released over two decades ago, predates the creation of Bitcoin and other cryptocurrencies that have emerged in recent years. The discussion around electronic payment systems and the government’s interest in creating a cashless society raises questions about the security and longevity of cryptocurrencies, especially in the context of the growing interest in central bank digital currencies (CBDCs) that prioritize transparency over anonymity.

As we reflect on the origins of cryptocurrencies and the government’s early explorations into electronic cash systems, it’s essential to consider how far we’ve come and where the future of digital payments may lead us. The intersection of technology, security, and privacy continues to shape the landscape of financial transactions and the evolution of money in the digital age.

Source link