At Extreme Investor Network, we strive to provide valuable insights and analysis on the latest trends in finance and investing. Today, we are diving into the recent data released by the Federal Reserve regarding inflation and household spending, and how it is impacting the market sentiment.

The latest data from the Federal Reserve’s core personal consumption expenditures price index showed a slight cooling in underlying inflation in the previous month. This news, combined with a rebound in household spending, didn’t sway the Wall Street consensus that has propelled stocks to record highs in the first quarter.

While the data may indicate a moderation in inflation, it remains higher than the Federal Reserve’s target, potentially limiting the scope for interest rate cuts this year. However, strategists are reassured by the data, suggesting that the economy is still holding up well following the Fed’s recent rate hikes.

Despite some optimistic signs in the data, swaps traders are cautiously trimming their bets on a rate cut as soon as June. Fed Governor Christopher Waller emphasized that there is no rush to lower interest rates, and recent economic data may warrant delaying or reducing the number of cuts expected this year.

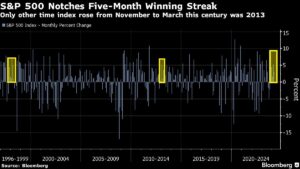

Fed Chair Jerome Powell acknowledged the latest data and mentioned that it aligns with expectations, though not as strong as readings from the previous year. The market has been on a tear in the first quarter, with the S&P 500 breaking records numerous times and boosting US equity values by $4 trillion. However, some market participants are beginning to worry about the market running too hot.

One of the concerning aspects of the recent report was the disconnect between spending and income. While higher spending can boost the economy in the short term, it’s unsustainable to spend more while earning less. Real personal spending increased last month, exceeding expectations.

Looking at the reactions from various Wall Street experts, the consensus remains cautious. There is a mixed view on the data, with some suggesting a potential hike in interest rates if growth continues to gain momentum. The evolution of incoming data will guide future interest rate decisions by the Fed.

At Extreme Investor Network, we understand that staying informed and analyzing the latest market trends is crucial for successful investing. Our team of experts is dedicated to providing unique insights and valuable information to help you navigate the ever-changing financial landscape. Stay tuned for more updates and analysis from Extreme Investor Network.