Welcome to Extreme Investor Network: Your Source for Exclusive Finance Insights

The first quarter of the year brought a whirlwind of events to the tech industry. From Nvidia’s soaring stock prices to Google’s mishaps with its Gemini image generator and Apple’s antitrust battles, the past three months have been a rollercoaster of highs and lows.

But fear not, because we are here to break down the most significant stories and provide you with exclusive insights that you won’t find anywhere else.

The Good News

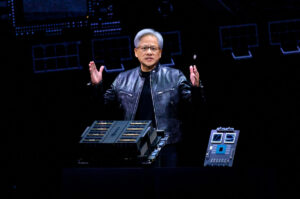

Let’s start with the positives. Nvidia has been dominating the AI landscape, with its stock prices skyrocketing and the company announcing impressive financial results. Their new Blackwell AI processor architecture stole the show at the GTC conference.

On the other hand, Intel secured $8.5 billion in funding under the CHIPS Act to boost its chip manufacturing capabilities, marking a significant development in the semiconductor industry.

Meanwhile, Apple made a strategic move by shifting focus from its electric car project to its AI division, aligning with the latest trends in the tech world.

In a groundbreaking announcement, Meta revealed its dividend payment and stock buyback program, sending its shares soaring.

The Bad News

Not everything was smooth sailing in the tech industry. Regulatory bodies like the FTC and the European Commission raised concerns about Big Tech’s investments in generative AI firms, hinting at potential antitrust issues.

Google faced backlash for the failure of its Gemini image generator, while legislators contemplated banning TikTok in the US, raising concerns about free speech rights.

The Ugly Truth

Some stories left a bitter taste in our mouths. The Department of Justice’s antitrust lawsuit against Apple and Elon Musk’s legal battle with OpenAI added to the drama in the tech world.

Moreover, the EV market faced challenges due to declining sales and range anxiety concerns, indicating a bumpy road ahead for electric vehicles.

At Extreme Investor Network, we are committed to providing you with insightful analysis, expert opinions, and exclusive updates on the latest financial trends that matter to you. Stay tuned for more exclusive content and in-depth coverage of the finance world.

For more exclusive insights and expert analysis, subscribe to Extreme Investor Network today. Join us as we navigate the complex world of finance together.