Critical information for the U.S. trading day

Given a war and inflation have marked the start of 2022, investors would be forgiven for holding their breath over the rest of the year’s offerings.

Our call of the day from a team at Saxo Bank sees a “wild ride” ahead for the second quarter and offers advice on which companies will best survive the upheaval.

The world is living through nothing less than “the arrival of the endgame for the paradigm that has shaped markets since the advent of the Greenspan Federal Reserve put in the wake of the LTCM [Long-Term Capital Management] crisis of 1998,” said Saxo’s chief investment officer Steen Jakobsen, in the bank’s second-quarter outlook on Tuesday.

Supply-side shocks from Russia’s invasion of Ukraine and COVID-19 have “accelerated our path toward more productivity. Policy simply must take us toward more price discovery and positive real yields as market and government actors fight for investment in a world, we now understand is highly constrained by absolute energy, environmental and capital limits,” he wrote.

Saxo sees three cycles simultaneously affecting markets — ongoing supply crunches from COVID-19, the war in Ukraine and the “world’s physical limits,” repricing of assets as inflation rises, and a new Fed tightening cycle that began in March.

The result of these will be more spending on energy, defense, supply-chain diversification, and negative real rates turning positive as the global economy readies for a productivity boost.

Here’s where equities come in. “With a large-scale war back in Europe and commodity markets in upheaval, this has aggravated inflationary pressures, and equities have entered an environment not seen since the 1970s. High inflation is essentially a tax on capital and raises the bar for return on capital, and thus inflation will filter out weaker and nonproductive companies in a ruthless fashion,” said Saxo’s head of equity strategy, Peter Garnry.

And one only needs to look at 1970s-era shareholder letters from Berkshire Hathaway’s BRK.B, 0.73% BRK.A, 0.74% billionaire chairman Warren Buffett, which pointed to productivity, innovation, or pricing power as a survival tool kit for companies, Garnry said.

“The largest companies in the world are the last to get hit from tighter financial conditions, and they also have the pricing power to pass on inflation to their customers for a longer time than smaller companies,” Garnry said. That means bye-bye to zombie companies kept alive by low-interest rates and excess capital.

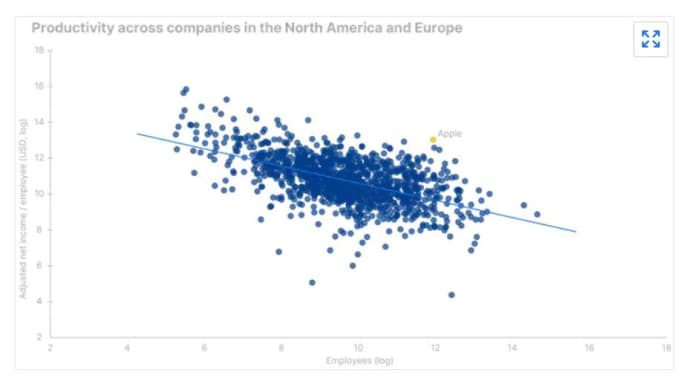

Garnry said one way to gauge productivity is by looking at adjusted net income to the employee, on the theory that the larger a company grows, the smaller its profit per employee.

“If a company is trying to maximize profits then that will often naturally lead to sacrificing productivity, but what is lost in productivity is gained through economies of scale in its operations, and this allows for higher levels of aggregated profits,” said Garnry.

Topping the ranks of companies that are the most productive relative to size — above the regression line — is Apple AAPL, -0.59%, he said.

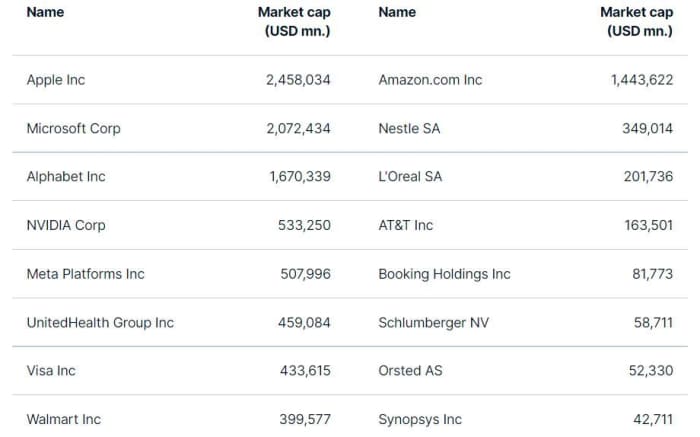

Here’s a sampling of the best companies for productivity and innovation, with Amazon AMZN, -0.97%, Microsoft MSFT, -0.48%, Nestlé NSRGY, 0.96% NESN, 0.77% and Alphabet GOOGL, -0.48% at the top of those lists.

Click here for more companies and Saxo’s full outlook.