By buying 73,486,938 shares of Twitter (TWTR), making him the company’s largest shareholder, Tesla (TSLA) CEO Elon Musk may have stirred up a hornet’s nest. That’s the message former White House official Darren Beattie offered in a prescient post published last week.

As Beattie notes, for those dismissive of the platform, Twitter’s societal impact transcends its relatively modest market cap:

Twitter’s market capitalization of barely $30 billion is extremely modest by Big Tech standards. Even Snapchat is twice as valuable. And yet, as the global public square, Twitter is also the epicenter of narrative formation, a key promotional vehicle for journalists and celebrities, and an increasingly critical stage for public diplomacy and hybrid warfare between state powers. Twitter gets to decide which “freedom fighters” deserve to have their slogans go viral and which “authoritarians” and “domestic terrorists” need to be suppressed and censored. Twitter’s relatively marginal market cap belies the existential threat it would pose to every dominant institution in the United States (including the national security apparatus) if it implemented a policy of real unfettered free speech. […]

What made Twitter so valuable and useful at its peak was that it really was a pan-ideological public square. It was (and, to a much lesser degree, still is) the only place where real dissidents and even ordinary people can directly and critically engage with the “bluecheck class.” Twitter, in a nutshell, was the place where a top reporter at the Washington Post or the former head of the CIA could be humiliated by an anonymous person with a cartoon frog avatar.

Beattie argues that if the establishment media decides an Elon Musk-influenced Twitter has become a threat, they will strike at it as they did at other social media platforms they found objectionable:

Think Twitter is too big to ever take down? Think again. If America’s ruling class acting in concert can silence a sitting United States president they are capable of cutting off virtually anything. Twitter itself has shown how it can be done, by simply banning links to web content it doesn’t want shared. In 2020, Twitter blocked links to the New York Post’s bombshell Hunter Biden story. The same year, Facebook blocked all links to Unz.com.

The same tools can absolutely be used against a new, free-speech Twitter. If Facebook blocked Twitter links and Google deranked its search results, the company would suffer huge hits to its traffic and bottom line. Media outlets could stop embedding or even linking Twitter threads as a protest against the platform’s “hate” or “extremism.”

Once again, the playbook has already been written, by the example made of Parler after January 6. Within four days of the Capitol incursion, both Apple and Google banned Parler from their app stores, and Amazon cut off its web hosting services. The fact that Parler finally returned more than a month later only drives home how successful the attack was. Parler didn’t even have to be totally destroyed to become totally irrelevant.

Musk should read the whole Revolver post to understand what he’s gotten into.

Some Advice

For some advice, Musk could do worse than peruse the viral thread below.

I think Darren Beattie would agree with the sentiment in the last tweet above, but I’m not sure if he’d agree with the suggestion. As he says in his Revolver article, Twitter’s power comes in large part from having those media professionals on the platform.

A Suggestion

Twitter shares spiked more than 27% on Monday on news of Musk’s 9.2% stake, and as I type this, they’re up another 3% in premarket trading. But as Morgan Stanley’s chief US equity strategist Mike Wilson warned recently, the bear market rally may be over. Given that, Elon might want to consider hedging his Twitter shares. Here’s a way of doing so.

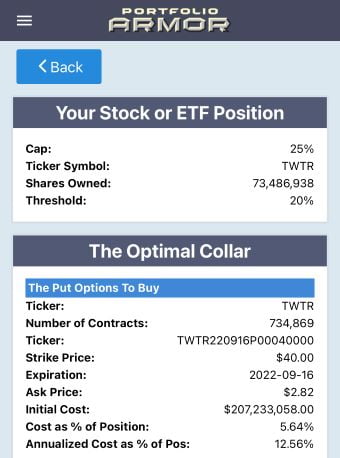

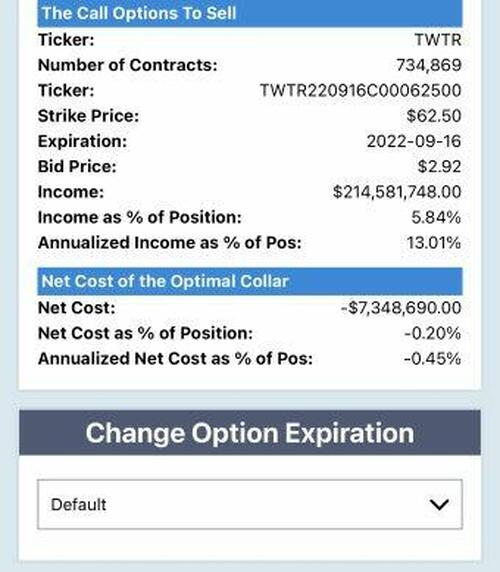

As of Monday’s close, this was the optimal collar to hedge 73,486,938 shares of Twitter against a greater-than-20% drop by mid-September, while not capping Elon Musk’s upside at less than 25% over the same time frame.

Note that the net cost of this collar was negative, meaning Musk would have collected a net credit of more than $7.3 million when opening the hedge. If the market slides over the next several months, and Twitter shares slide along with it, Musk may be able to buy-to-close the call leg of his collar for a fraction of the premium he received for it. eliminating his upside cap.