Understanding the Economic Dynamics Behind High Inflation

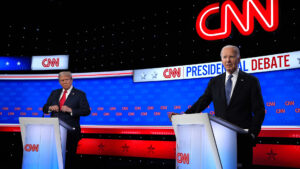

In a recent U.S. presidential debate, both former President Donald Trump and President Joe Biden squared off on the topic of the economy, with high pandemic-era inflation at the forefront of their discussion. Trump pointed the finger at Biden, claiming that he caused the inflation, while Biden argued that Trump’s policies decimated the economy during his term. However, economists suggest that the cause of inflation is more complex and cannot be solely attributed to a single president’s actions.

Consideration of Global Events and Policy Impact

Economists highlight that global events beyond the control of any specific president have greatly impacted supply-and-demand dynamics in the U.S. economy. Factors such as the Federal Reserve’s handling of hot inflation, pandemic relief packages, and the concept of "greedflation" have all played a role in fueling higher prices. It is important to note that individual presidents often receive more credit or blame for economic outcomes than they actually deserve.

The Influence of Changing Consumer Behavior and Supply Chain Disruptions

The pandemic significantly disrupted global supply chains, leading to shortages in goods and labor. Consumer behavior also shifted, with a focus on purchasing physical goods rather than services as people spent more time at home. As a result, demand surged when the economy reopened, exacerbating inflation. Other contributing factors include issues such as semiconductor chip shortages for automakers and disruptions caused by Russia’s war in Ukraine.

Evaluating Policy Decisions and Their Inflationary Impact

Both Biden and Trump implemented significant government spending measures during the pandemic, such as the American Rescue Plan and stimulus packages, which had inflationary effects by increasing consumer demand. While these policies had some positive impact on the economy, their magnitude may have contributed to rising prices.

Role of the Federal Reserve and Corporate Behavior

The Federal Reserve plays a crucial role in controlling inflation through interest rate adjustments. Some economists argue that the Fed was slow to respond to rising inflation and that its policy decisions may have exacerbated the situation. Additionally, the concept of "greedflation" – corporations taking advantage of the high-inflation environment to increase prices excessively – is suggested as a minor factor in inflationary pressures.

In conclusion, the causes of high inflation are multifaceted and involve a combination of global events, policy decisions, changing consumer behavior, and corporate practices. Understanding these complex dynamics is key to navigating the current economic landscape effectively. Stay informed and engaged with our expert analysis and insights at Extreme Investor Network to make informed financial decisions in these challenging times.