Quick takes:

- Use this draw-down as an opportunity.

- The markets collapsed Thursday from leveraged ETFs (SQQQ & TQQQ) selling $15bn and option dealers selling huge amounts of gamma into the market.

- The Fed will NOT let pensions explode and create a massive retirement crisis in order to fight 8.5% inflation.

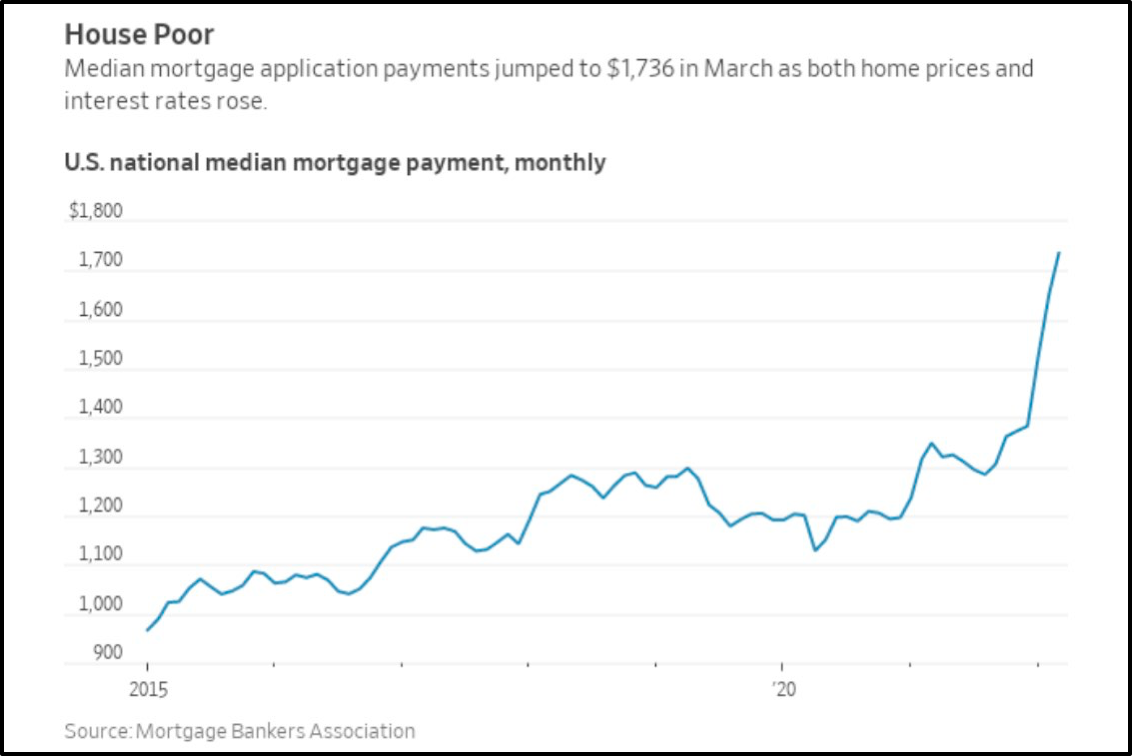

- Inflation is already decelerating (used cars/mortgages)

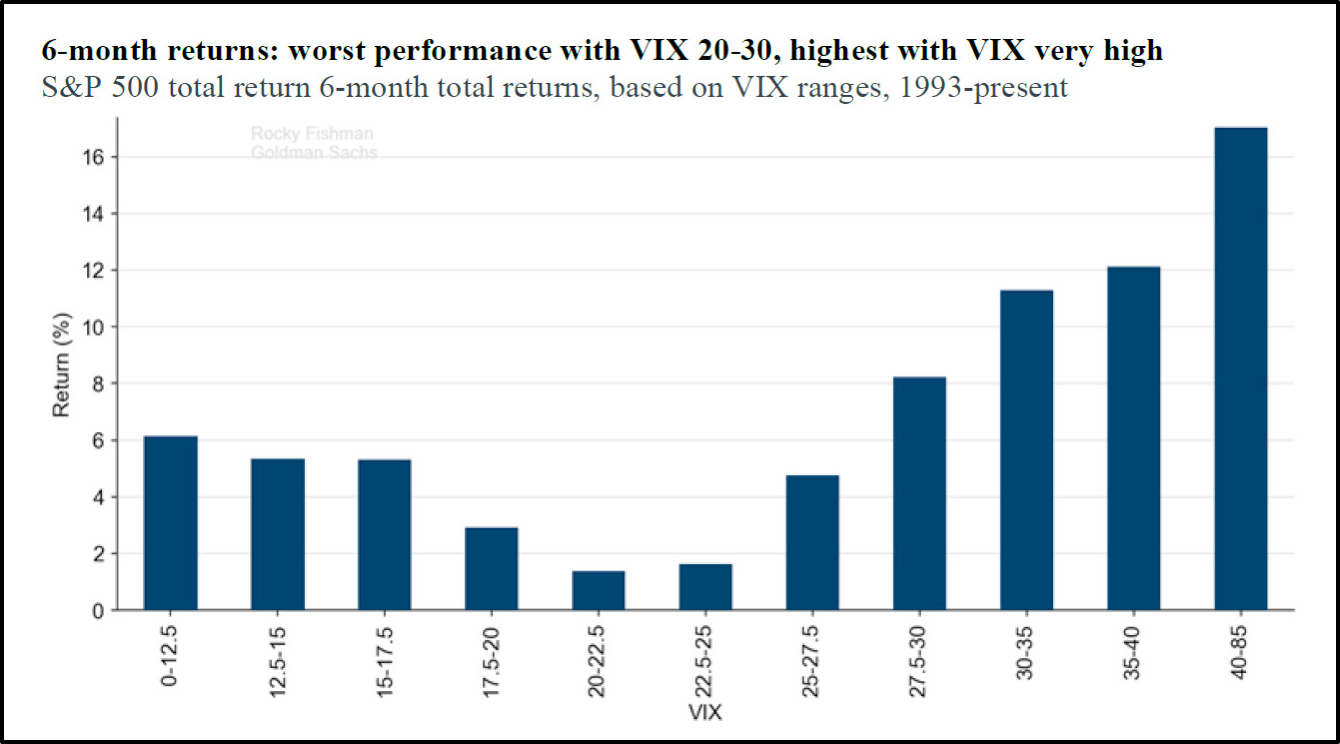

- 6-month returns after VIX spikes to 35+ are 10%+

- Roughly half of Nasdaq stocks are down 46.5% from their 52-wk high.

Remember, there is a greater chance the fed becomes incrementally more dovish than hawkish in 6-9 months. (Bullish) The fed already denied a 75bps hike just last week.

S&P 500: Leaving this here for now. Needs to hold 4,000

6-month returns after VIX spikes to 35+ are 10%+

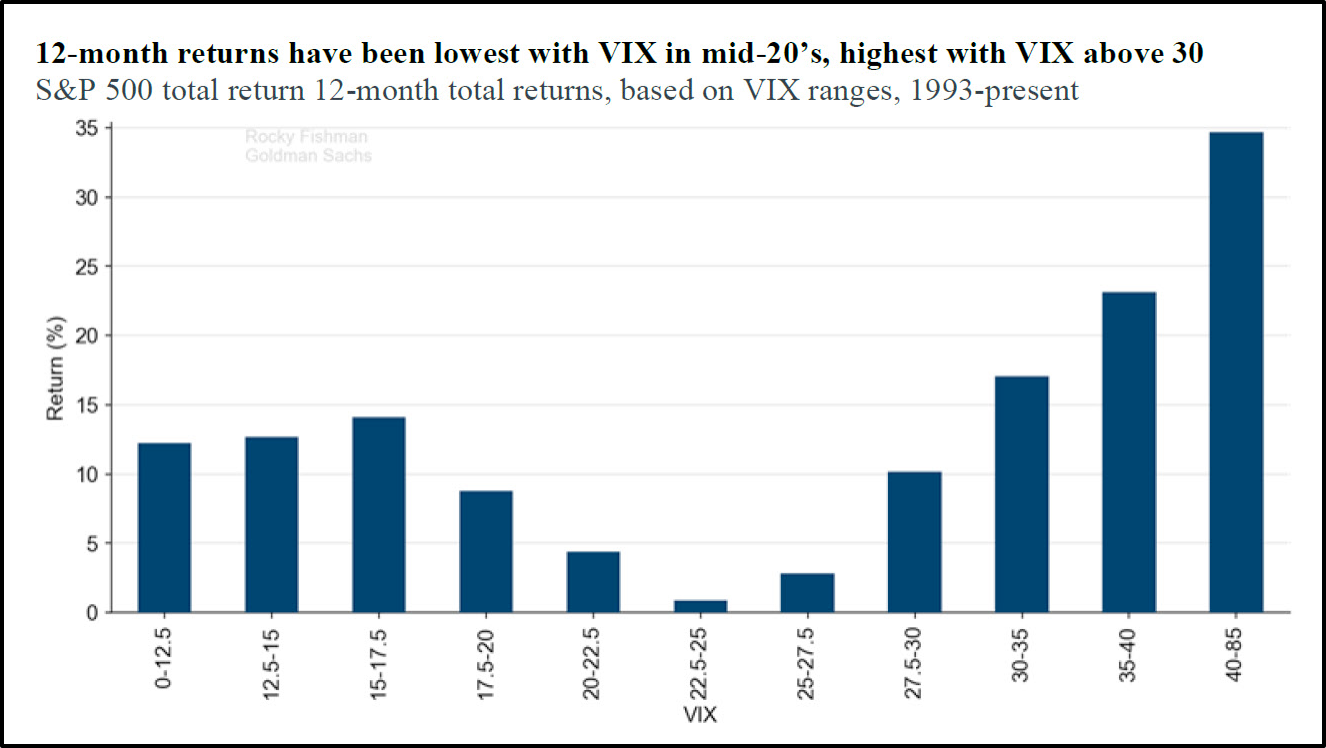

12-month returns after VIX spikes to 35+ are 20%+

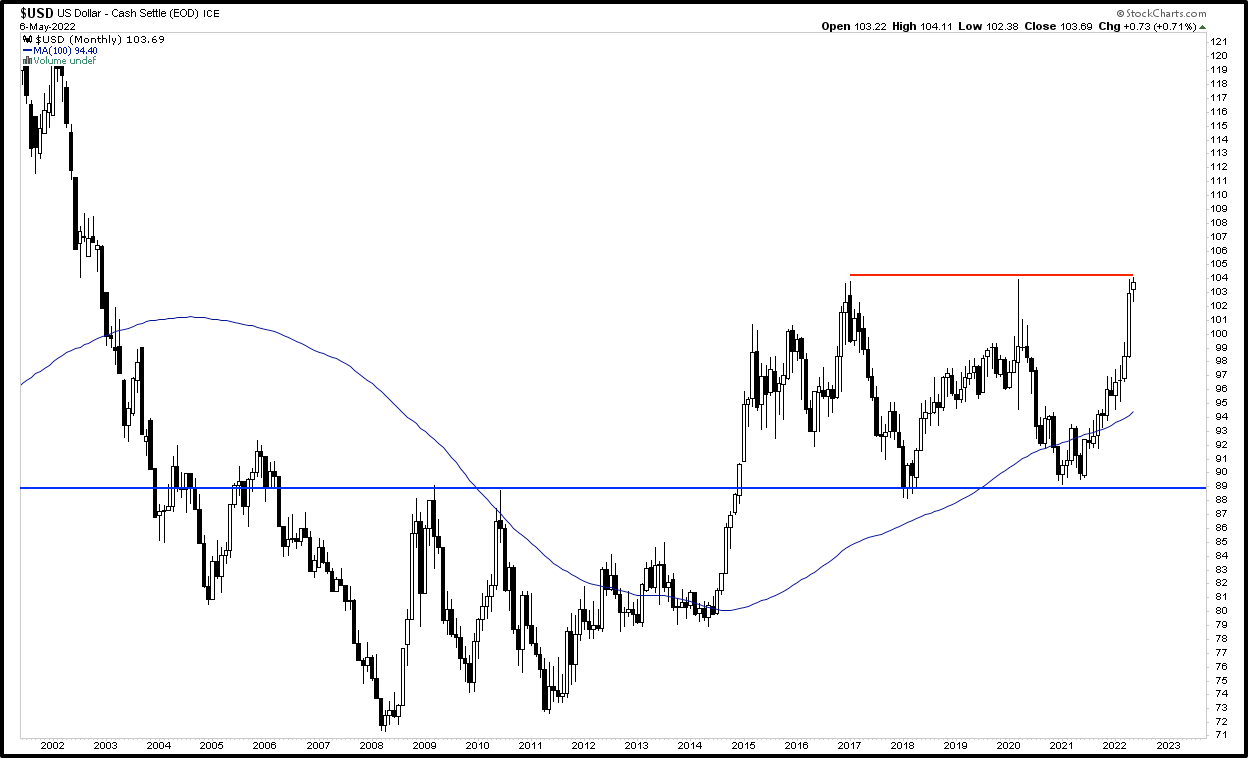

USD has been too strong, which adds to the tightening. It is weakening at resistance here.

After an amazing quarter, AMD needs to break over $100 in order to be called a bottom.

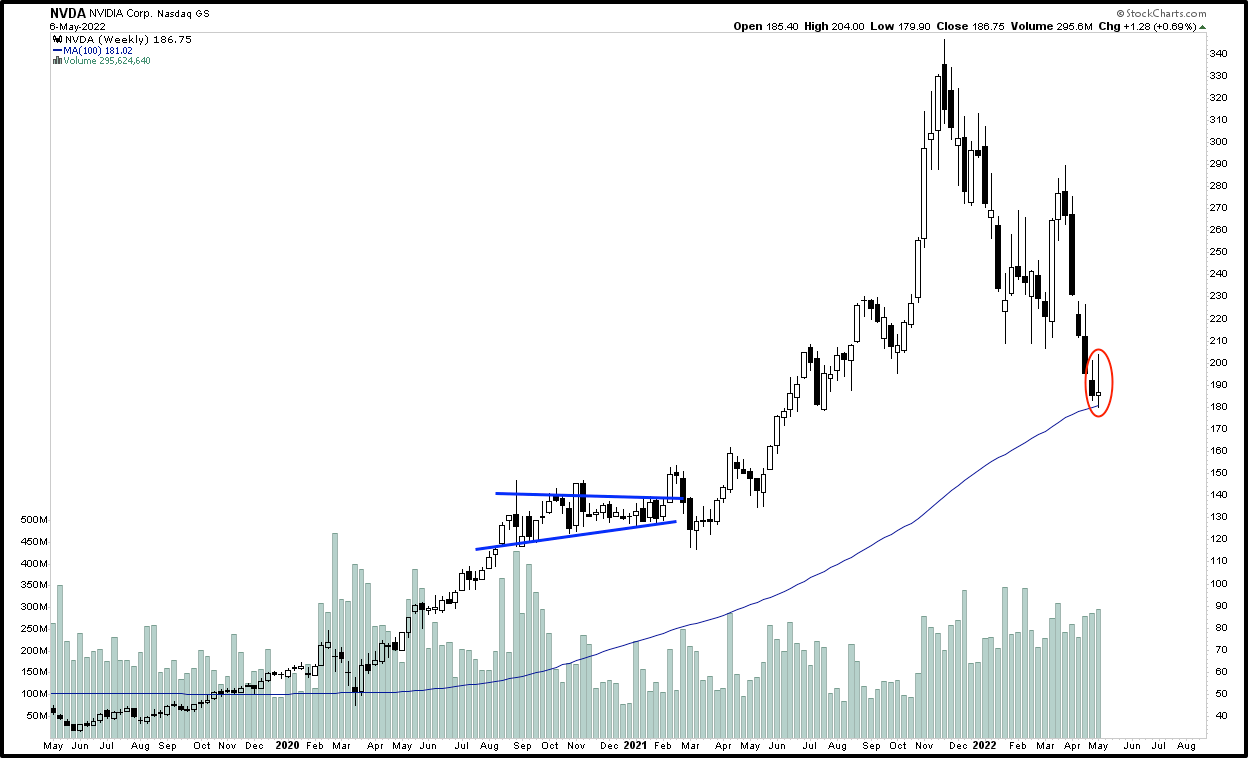

Nvidia is in a much better spot on the 100MA. Below $170 wouldn’t be good. The risk/return to the upside is better right now.

This won’t last.

Return always wants its risk payment. Not Investment Advice.