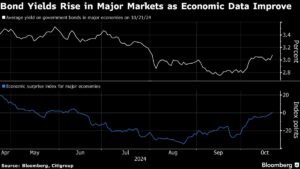

As we dive into the current state of the global bond market, the jitters felt by investors are palpable as they assess the potential impact of slower US interest rate cuts. The recent surge in yields on Australian, New Zealand, and Japanese bonds, coupled with two-month highs in US and German yields, paints a picture of uncertainty and volatility in the fixed-income market.

At the core of this global bond selloff lies the speculation surrounding Federal Reserve rate-cut expectations. With a robust US economy, mounting odds of a Donald Trump reelection, and cautious remarks from Fed officials on the pace of monetary easing, bond traders find themselves at a crossroads, grappling with the uncertain future of bond yields.

Renowned economist Ed Yardeni predicts US 10-year yields could reach 4.5% early next year, with a possibility of climbing to 5% depending on the election results and widening deficits. Overnight-indexed swaps hint at a 25-basis-point Fed rate cut next month no longer being a sure bet, leading some to believe that rates may stay unchanged at the next Fed meeting.

As US 10-year yields continue to rise, hitting 4.22% in Asia, Treasury volatility has spiked to its highest level this year. Bloomberg Strategists foresee a challenging road ahead for Treasuries, with a strong bias toward higher yields amid growing supply concerns and a resilient US economy.

While the Reserve Bank of Australia and Bank of Japan recalibrate their rate-cutting strategies, some analysts anticipate a slight correction in the bond market. However, uncertainties surrounding US debt supply, election dynamics, and geopolitical tensions could fuel larger-than-usual fluctuations in Treasuries in the near term.

Despite the looming selloff, the likes of the Fed and Reserve Bank of New Zealand remain on a path of rate cuts, which could lend support to bonds. But the prevailing sentiment among investors, as echoed by BlackRock Investment Institute, is to remain cautious, with an underweight stance on shorter-maturity Treasuries given the unpredictability of market conditions.

At Extreme Investor Network, we understand the importance of staying ahead of market trends and making informed investment decisions. Our expert analysis and insights provide you with the tools needed to navigate through turbulent times and maximize your investment potential. Stay connected with us for the latest updates and exclusive content that will empower you to make strategic financial choices.