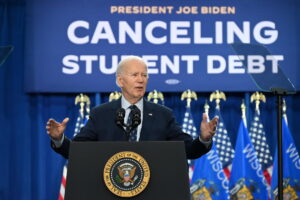

At Extreme Investor Network, we pride ourselves on providing unique and valuable insights into all things finance. Today, we are diving into the hot topic of President Biden’s renewed efforts to cancel student loan debt for up to 25 million borrowers. This latest plan comes on the heels of the Supreme Court’s rejection of his initial attempt last year.

If approved, the new plan would see the government reducing student loan balances for the majority of Americans by anywhere from $5,000 to $20,000. This move is expected to inject much-needed cash into the economy, with economists predicting a boost in spending and economic growth. However, it’s important to note that while this may seem like “free” money, the government is essentially forgoing future revenue by canceling debt payments, adding to annual deficits and the total national debt.

The cost of the latest plan has not been explicitly stated by the Biden administration, but estimates suggest that if forgiveness averages $5,000 per borrower, the forgone revenue could total around $125 billion over several years. On the other hand, if the average forgiveness amount is $20,000 per borrower, the cost could soar to $500 billion.

In the grand scheme of federal budgeting, $400 billion may seem like a drop in the bucket, constituting only 1.2% of the total national debt. However, when compared to other budgetary measures, such as the 2022 Inflation Reduction Act, which aimed to reduce deficits by $275 billion over a decade, the impact of student debt cancellation cannot be overlooked.

Biden’s push for student debt relief through executive action highlights the fact that Congress has been hesitant to tackle this issue legislatively. Despite Democratic control of both houses during Biden’s first two years in office, the lack of bipartisan support for debt cancellation was evident. Many lawmakers believe that taxpayer dollars could be better spent on aid programs targeting those who need it most, rather than benefiting individuals with higher education levels.

Furthermore, without corresponding reforms to the student debt program, loan cancellation could be a one-time windfall for a select group of borrowers. This could lead to a cyclic pattern of debt relief initiatives, potentially inflating the total amount of outstanding student debt in the long run.

As the political and fiscal debate rages on, it is clear that student loan debt cancellation is a complex issue with wide-reaching implications. At Extreme Investor Network, we strive to demystify these financial matters and provide our readers with expert analysis and insights. Stay tuned for more updates on this evolving story and other impactful financial news.