Welcome to Extreme Investor Network, where we provide expert insights and analysis on all things finance. Today, we’re diving into the exclusive $1 trillion club, consisting of only six members, all U.S. companies with a market capitalization of at least $1 trillion. These members include tech giants like Microsoft, Apple, Nvidia, Alphabet, Amazon, and Meta Platforms, all of which are leaders in artificial intelligence (AI).

But who will be the next AI stock to join this elite club? Our prediction points to Broadcom (NASDAQ: AVGO) as the next in line behind the current members. While companies like Berkshire Hathaway and Eli Lilly may reach the $1 trillion mark first, Broadcom is not far behind, with a current market cap exceeding $610 billion.

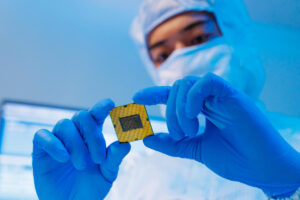

Despite needing a 64% jump in stock price to reach $1 trillion, Broadcom’s recent performance suggests this milestone is within reach. The acquisition of VMware and strong demand for chips to power AI applications position Broadcom for accelerated growth.

In comparison, other contenders like Tesla (NASDAQ: TSLA) and Taiwan Semiconductor Manufacturing (NYSE: TSM) face challenges that give Broadcom an edge. While Tesla grapples with increased competition and plateauing consumer interest in EVs, Taiwan Semi faces mounting pressure from rivals and geopolitical tensions.

As for investing in Broadcom, our analysis suggests caution due to the company’s current valuation at nearly 29 times forward earnings. While strong growth is expected, the current price may not be compelling for investors looking for immediate returns.

Before diving into Broadcom stock, consider the insights from the Motley Fool Stock Advisor team, who have identified the 10 best stocks for investors to buy now. While Broadcom may not be on their list, the recommended stocks have the potential to generate significant returns in the coming years.

At Extreme Investor Network, we provide in-depth analysis and recommendations to help investors make informed decisions. Stay tuned for more expert insights on finance, investing, and market trends. Join us on the journey to financial success.