Tencent’s Strategic Shift: Embracing AI and Expanding Horizons

In a move that underscores its commitment to innovation, Tencent Holdings Ltd. has announced ambitious plans to significantly increase its investment in artificial intelligence (AI) infrastructure. Following a remarkable surge in revenue—reflecting an 11% increase to 172.5 billion yuan ($23.8 billion) in the last quarter—Tencent is positioning itself to maintain its competitive edge against rivals in the rapidly evolving landscape of AI technologies.

Revenue Growth and Financial Highlights

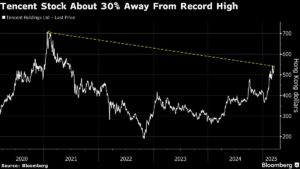

Tencent’s recent earnings reveal not just strong revenue growth but also a doubling of net income, showcasing the company’s resilience and strategic planning. Alongside these impressive figures, Tencent unveiled a share buyback program worth at least HK$80 billion and proposed a 32% increase in its annual dividend for 2025, signaling confidence in its financial health and future prospects.

A Balanced AI Approach

While Alibaba Group is embarking on an aggressive AI development plan, Tencent is opting for a more moderated strategy. CEO Pony Ma emphasized the importance of “careful consideration” in their AI endeavors, stating that the company will leverage both in-house and open-source AI models. This dual strategy parallels their approach to game publishing, allowing Tencent to capitalize on multiple avenues of growth within the gaming ecosystem.

Capitalizing on AI Demand

Tencent aims to channel a significant portion of its projected revenue into AI-related capital expenditures—more than $10 billion based on analysts’ forecasts for 2025. This investment will focus on enhancing advertising platforms and enhancing services like WeChat. Interestingly, President Martin Lau mentioned that AI is still in its nascent stages, hinting at future growth potential that could revolutionize user experiences across Tencent’s applications.

Addressing Market Dynamics

In response to increased demand, Tencent has ramped up its acquisition of AI chips, aiming to bolster cloud revenue growth. The company’s strategy includes navigating around U.S. restrictions on advanced Nvidia semiconductors. Chief Strategy Officer James Mitchell noted the capabilities demonstrated by emerging players like DeepSeek—highlighting an industry-wide shift that emphasizes cost-effective breakthroughs in AI technology.

Competition and Industry Symphony

The competitive field is heating up, especially following a recent symposium attended by President Xi Jinping and influential tech leaders, including Tencent’s Ma and Alibaba’s co-founder, Jack Ma. This meeting showcased Beijing’s softening stance towards the tech sector, which could herald a renewed era of collaboration and growth in the industry amid heightened competition with U.S. technology firms.

DeepSeek’s launch of a rival to OpenAI’s models has ignited a competitive response from major tech players in China. Notably, Alibaba has pledged over $50 billion toward AI and cloud development, signaling a significant investment in this sector.

WeChat: A Pillar of Growth

WeChat remains one of Tencent’s most dependable assets, boasting over a billion users. The app is set to take on an increasing monetization role, expanding into areas like online commerce and advertising while delivering consumer services that reflect the economic landscape.

As Tencent gears up for 2025, the company is focused not only on strong financial performance but also on ensuring that its gaming portfolio remains robust. With anticipated releases—including popular titles like Honor of Kings: World and Goddess of Victory: Nikke—Tencent is positioning itself to potentially replicate its past success while streamlining its operations for maximum impact.

Conclusion

In summary, Tencent’s strategic emphasis on AI infrastructure, coupled with its fiscal prudence and diversified approach to innovation, positions it favorably in a rapidly changing technological environment. With an eye on both competition and collaboration, Tencent aims to not only secure its place in the market but also to redefine user experiences across its platforms. As the battle for AI leadership intensifies, the company’s next moves will be crucial in shaping the future landscape of the tech industry.

For the latest updates and insights on fintech, technology investments, and market trends, stay connected with Extreme Investor Network.