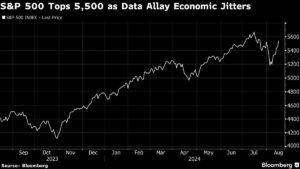

In the world of finance, every movement in the market can have significant implications for investors. This week, stocks were on track for their best performance in 2024, but this rally lost steam on Friday as traders closely analyzed the latest economic data to gauge the Federal Reserve’s next steps.

As we approach Jerome Powell’s upcoming speech at the Jackson Hole Economic Policy Symposium, investors are paying close attention to any hints about the Fed’s policy outlook. The recent data suggests that the Fed may not need to rush into aggressive easing measures, which has led traders to adjust their expectations for rate cuts.

Despite some positive signs, such as a rise in US consumer sentiment and stable inflation, there are still concerns about the economy. The mixed economic data has left investors bracing for more volatility in the near term.

Florian Ielpo of Lombard Odier Investment Managers cautions against excessive optimism, noting that there are still contradictions in the economic data that warrant careful consideration.

The market landscape remains uncertain, with the S&P 500 and Treasuries showing minor movements while gold reached $2,500 for the first time. Powell’s upcoming speech will likely shed more light on the Fed’s stance and the potential for interest rate cuts in the near future.

At Extreme Investor Network, we understand the importance of staying informed and making strategic investment decisions. As experts in the field of finance, we are committed to providing unique insights and in-depth analysis to help our readers navigate the complexities of the market.

In addition to the latest market updates, we also provide exclusive content on corporate developments, such as recent news about Texas Instruments Inc., Rivian Automotive Inc., Bayer AG, BHP Group, and more. Our goal is to empower investors with valuable information that sets us apart from other financial news sources.

Stay tuned for more updates and analysis from Extreme Investor Network as we continue to monitor the ever-evolving world of finance. With our expertise and insightful content, you can make informed investment decisions and stay ahead of the curve in today’s dynamic market environment.