The Rise of MercadoLibre: The Amazon of Latin America

MercadoLibre (NASDAQ: MELI) is often referred to as the Amazon of Latin America, and for good reason. As the largest e-commerce company in the region, it has seen staggering growth over the past decade, with its stock soaring 1,500% and compounding at an annual rate of 31%. In comparison, $10,000 invested in MercadoLibre in 2014 would now be worth over $152,000, while the same amount invested in the S&P 500 would only amount to around $28,000.

Despite its success, MercadoLibre remains significantly smaller than Amazon, with a market capitalization of just $75 billion. However, Wall Street analysts like Marcelo Santos at JPMorgan Chase and Andrew Ruben at Morgan Stanley still see the company as a promising investment.

MercadoLibre’s success can be attributed to its Amazon-like approach, building a robust ecosystem of services that support its marketplace and create additional monetization opportunities. With the largest e-commerce and payments ecosystem in Latin America, it holds a market share of about 29% in online retail sales across the region, a figure expected to grow to 31% by 2027.

The company’s scale has created a network effect similar to Amazon’s, pulling in more merchants and consumers over time. Additionally, MercadoLibre offers logistics support, advertising services, credit products, and payment processing, enhancing its marketplace and making it even more attractive to users.

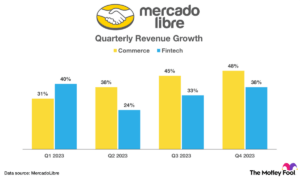

In the fourth quarter of last year, MercadoLibre reported accelerated growth in both its commerce and fintech segments, with total revenue increasing by 42%. Its logistics network saw record numbers, handling 94.4% of shipments and fulfilling 50% of deliveries during the quarter. Advertising services revenue also saw impressive growth, exceeding 70% for seven consecutive quarters.

Looking ahead, MercadoLibre has significant growth opportunities in e-commerce, financial services, and digital advertising. With projected annual growth rates ranging from 8% to 17%, the company is expected to continue its upward trajectory in the coming years.

In conclusion, MercadoLibre’s current valuation presents a reasonable opportunity for investors, with its potential for future growth and expansion. Patient investors willing to take a position in this growth stock may reap significant rewards in the long run.

In summary, MercadoLibre’s success story as the Amazon of Latin America serves as an inspiring example of how companies can thrive in the e-commerce space by following a proven blueprint of innovation and customer-centric services.

Sources:

– The Motley Fool

– Yahoo Finance

– Straits Research

– Grand View Research

– World Bank

Source link