**Generate Passive Income with Reliable Dividend Stocks**

Are you looking for ways to boost your portfolio growth through passive income? One of the best strategies to consider is investing in dividend stocks. However, not all dividend-paying companies provide equally reliable opportunities.

At Extreme Investor Network, we have identified five established dividend payers that have a track record of delivering consistent returns to investors. By holding onto these stocks over the long term, you can potentially see massive gains in your portfolio.

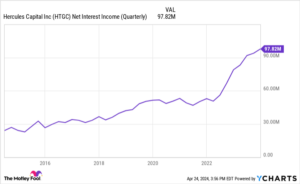

**1. Hercules Capital (NYSE: HTGC)**

Hercules Capital is a Business Development Company (BDC) that focuses on providing high-yield loans to startups in industries such as technology, life sciences, and renewable energy. With a dividend yield of 10.4%, Hercules has demonstrated strong performance and a commitment to rewarding shareholders.

**2. Ares Capital (NASDAQ: ARCC)**

Unlike Hercules, Ares Capital targets lower middle market businesses and offers more sophisticated financial products such as leveraged buyouts. With a current yield of 9.3% and a price-to-book ratio in line with its historical average, now could be an opportune time to consider investing in Ares.

**3. Rithm Capital (NYSE: RITM)**

Rithm Capital is a Real Estate Investment Trust (REIT) specializing in financial services and commercial real estate. While facing challenges related to inflation and borrowing costs, Rithm offers a compelling 9.2% yield and potential for long-term growth.

**4. Energy Transfer (NYSE: ET)**

As a Master Limited Partnership (MLP) in the natural gas industry, Energy Transfer provides income investors with attractive distributions similar to dividends. With a history of raising distributions and a focus on stable long-term contracts, Energy Transfer presents a compelling opportunity for investors seeking income.

**5. Enterprise Products Partners (NYSE: EPD)**

Enterprise Products Partners operates in the midstream energy sector, with a strong track record of navigating economic challenges and rewarding shareholders. With a 7.1% dividend yield and significant new business projects underway, Enterprise Products Partners is well-positioned for long-term growth.

At Extreme Investor Network, we believe that investing in reliable dividend stocks is a proven strategy for generating passive income and building wealth over time. By carefully selecting companies with a history of consistent performance and shareholder rewards, you can enhance your portfolio’s growth potential.

*Disclosure: The author of this content has no position in any of the stocks mentioned. Extreme Investor Network may have positions in or recommend the mentioned companies. Please refer to our disclosure policy for more information.*

Invest in these high-yield dividend stocks today and set yourself up for a decade of robust returns. Make sure to visit Extreme Investor Network for more exclusive insights and investment opportunities.