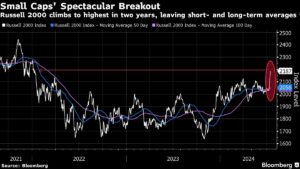

The latest surge in the small-cap stock market has caught the attention of traders, as the Russell 2000 Index has seen a 12% increase in the last five sessions, a feat not accomplished since April 2020. This sudden rally has been fueled by new data on inflation, particularly last week’s consumer price index report, which led traders to adjust their expectations for when the Federal Reserve might cut interest rates.

Smaller companies are often more sensitive to changes in borrowing costs due to their heavier debt loads compared to larger firms. As a result, the progress in inflation data has sparked a renewed interest in small-cap stocks, causing a flurry of activity in the market.

According to Cole Wilcox, CEO of Longboard Asset Management, hedge funds and traders were caught off guard by the lower than expected inflation, leading to a sharp rally in small caps. Data on Russell 2000 futures show that traders had pushed their exposure to the most net-short since 2023, indicating a significant shift in sentiment towards small-cap stocks.

Despite the recent rally, small caps have faced several false starts in the past few years, with fluctuating expectations for Fed rate cuts. The group’s valuations have dropped to historic lows, making them attractive targets for investors looking to capitalize on the market’s risk-on tone.

In addition to improving valuations, the earnings outlook for small caps is also beginning to show signs of recovery. Consensus revenue and net income growth forecasts for the Russell 2000 suggest a strong rebound in late 2024, bringing it closer to the S&P 500. Options positioning further indicates growing optimism among investors, with implied volatility for one-month options on the iShares Russell 2000 ETF at its highest level since April.

However, some Wall Street experts caution that the small-cap rally may be reaching overheated levels, with the Russell 2000 showing signs of being overbought. Until strong earnings confirm the sustainability of the rally, skeptics are advising caution when considering small-cap investments.

At Extreme Investor Network, we believe in providing expert insights and analysis to help investors navigate the ever-changing financial landscape. Stay tuned for more updates and valuable information to help you make informed investment decisions.