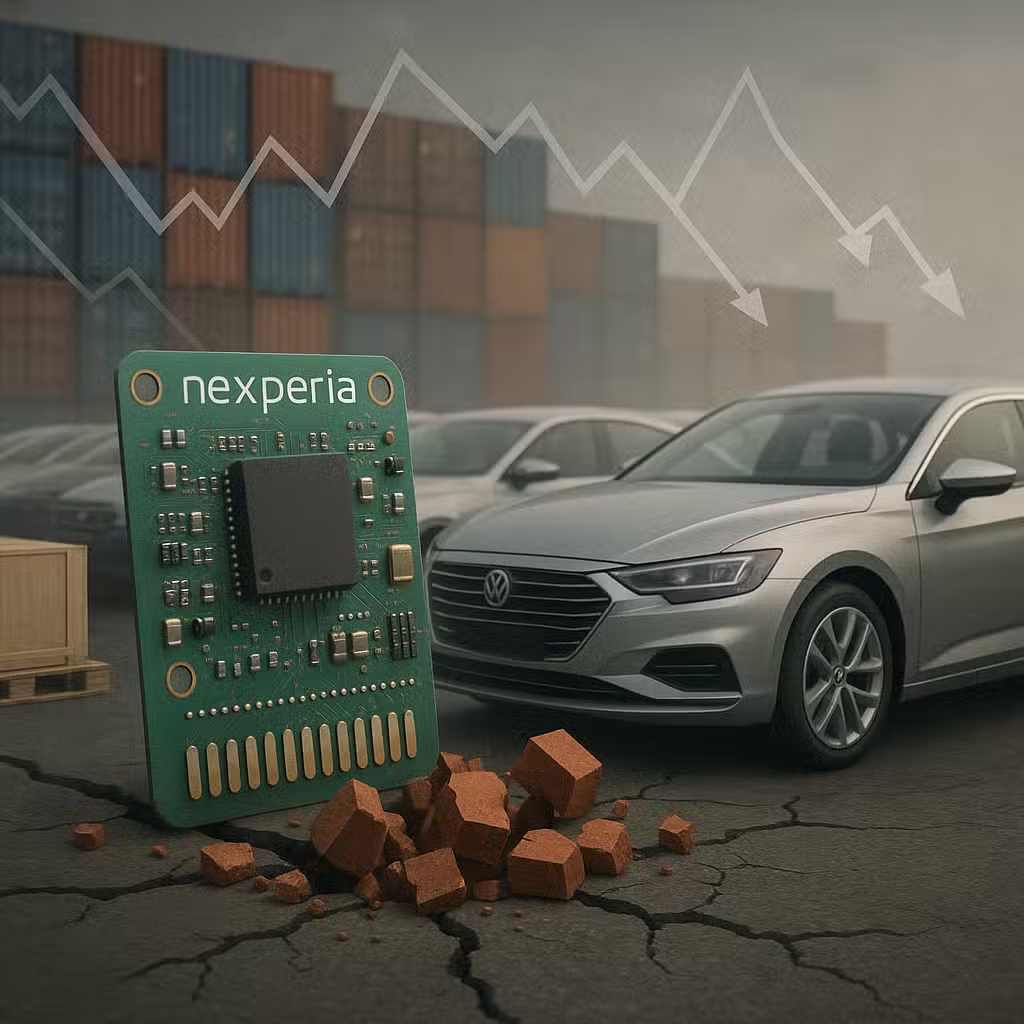

Nexperia Supply Disruption Highlights Key Risks for Auto Industry Investors

Imagine if a single missing puzzle piece could stop you from finishing a huge picture. That’s what’s happening in the car industry right now because of a fight over a company called Nexperia, which makes important computer chips for cars.

What’s Going On With Nexperia?

Nexperia is a Dutch company owned by a Chinese firm called Wingtech. They make simple chips that help cars do things like control headlights, manage batteries, and keep brakes working safely. Recently, a disagreement over who controls Nexperia nearly stopped the flow of these chips, which are needed by carmakers all over the world.

Why did this happen? The Dutch government took over Nexperia because they were worried about national security. They didn’t want important technology falling into the wrong hands. This made China angry, so they blocked Nexperia’s chips from leaving their factories for a while.

Why Investors Should Care

This isn’t just a business spat—it’s a big deal for investors, especially those interested in cars, technology, or global trade. When chip supplies get squeezed, car companies can’t build as many vehicles. That means lower sales, lost profits, and possibly falling stock prices for automakers and their suppliers.

- Honda had to stop making cars in Mexico because they couldn’t get enough chips from Nexperia.

- General Motors, Ford, Nissan, and Mercedes-Benz all warned that they might have to slow down or stop production if the chip shortage continued.

- Big carmakers like BMW, Renault, Volkswagen, and Volvo have been dipping into their emergency chip stashes to keep factories running.

According to S&P Global Mobility, Nexperia makes up only about 5% of the auto chip market by revenue, but their parts are used in huge numbers—sometimes dozens or even hundreds in a single car.

The Bull Case: Signs of Hope

- After talks between the U.S. and China, there are signs the chip flow might return to normal.

- Honda says it expects to restart its Mexican plant soon, which can make up to 200,000 cars a year.

- Europe and China are talking about making chip exports easier, which could help stabilize the supply chain.

The Bear Case: Risks Remain

- Even if chips start moving again, finding new suppliers isn’t easy. Car companies can’t just swap to another chip overnight.

- If the fight over Nexperia flares up again, more factories could face shutdowns, hurting auto stocks and related sectors.

- This dispute is part of a bigger battle between the U.S. and China over tech, which could mean more supply chain shocks in the future.

For context, the global chip shortage during the COVID-19 pandemic cost the auto industry $210 billion in lost revenue in 2021, according to AlixPartners.

Historical Lessons for Investors

This isn’t the first time a supply chain issue has rocked the auto sector. In 2011, the tsunami in Japan disrupted chip supplies, causing global factory shutdowns. The lesson? Small parts can have a huge impact on big industries.

Investor Takeaway

- Stay Diversified: Don’t put all your money into one sector, like autos or chips. Supply chain surprises can hurt even the biggest companies.

- Watch Geopolitical Risks: Pay attention to news about trade wars and tech disputes—these can move markets fast.

- Look for Resilient Companies: Some carmakers and chip firms handle disruptions better than others. Research which ones have strong supply chains.

- Use History as a Guide: Past shortages have eventually been resolved, but they can cause short-term pain. Think long-term if you’re investing in affected sectors.

- Keep an Eye on Recovery: Positive news about chip flows restarting could be a good sign for auto stocks and suppliers.

For the full original report, see Yahoo Finance