Asian Stocks Rise on Positive Economic Data and Awaited Policy Decisions

The Asian stock market saw gains today as investors looked to upcoming policy decisions in Japan and the US for trading cues. The MSCI Asia Pacific Index advanced, driven by a rally in Japanese stocks, particularly in the tech-heavy Nikkei 225 index.

China also saw gains in its mainland equities, buoyed by better-than-expected factory output and fixed-asset investment growth. Meanwhile, US equity futures inched higher after a 0.7% dip in the S&P 500 on Friday.

Speculation is high that the Bank of Japan will scrap its negative-rate policy on Tuesday, with many observers expecting the move following strong wage deals announced by Japan’s largest union group. The yen has weakened against the dollar as a result.

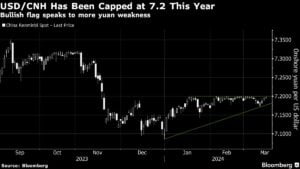

In China, economic numbers outperformed expectations, providing further evidence of the country’s economic strength. However, the Chinese yuan remains in a tight range amid uncertainties surrounding China’s central bank and the upcoming Federal Reserve policy meeting.

The week ahead holds several key events that could impact global markets, including the Fed’s policy meeting on Wednesday and policy decisions from the Reserve Bank of Australia, Bank Indonesia, and the Bank of England. Eurozone inflation data and Reddit Inc.’s IPO are also on the docket.

Commodities markets saw oil prices rise following positive macro-economic data from China and heightened geopolitical risks in Ukraine. Gold prices dipped slightly, while iron ore fell to its lowest level since last May.

In summary, the market remains poised for potential shifts based on upcoming policy decisions and economic data releases throughout the week. Stay tuned for more updates on how these events may impact global markets.

Source link