How vulnerable is the equity market? It’s very susceptible.

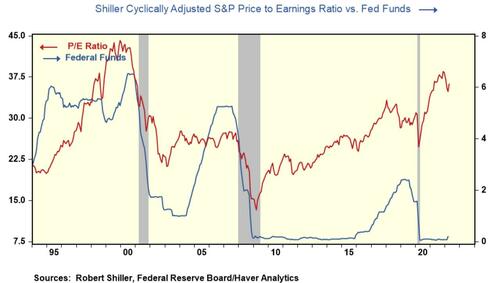

The cyclically-adjusted price to earnings ratio is running twice as high as the historical average. Meanwhile, Fed is in the early stages of raising official rates and draining liquidity which has proven to be the death knell for the equity market.

First, of course, no two investment cycles are ever identical. Different fundamental factors, such as earnings, interest rates, inflation, and policy stances, separate one period from another. Yet, it is still possible to learn how vulnerable the equity market is to a regime change toward tighter monetary policy.

Shiller’s cyclically adjusted P/E ratio for the S&P 500 enables one to compare the current market valuation across long periods. However, it’s not a short-term market predictor as it captures a rolling 10-years of earnings (inflation-adjusted).

The long-term average cyclically-adjusted P/E average is 16/17. But in the last thirty years, the market has traded well above that, and two periods stand out. The periods are; the mid-to-late 1990s and the previous decade. Monetary policy played a huge role in these equity market surges and its abrupt decline in the early case.

In the mid-1990s, policymakers abandoned its monetary anchor and adopted an implicit price rule. At that time, domestic and global factors were restraining wages and prices, enabling the Fed to maintain a steady official rate policy. That benign price environment and easy money policy helped create low-risk perceptions, leading to mispricing of risks and overestimating equity returns.

In the last decade, policymakers adopted an explicit price rule. They followed it by making a clear promise to maintain an easy money policy until it hit its target. Then when prices ran below target, policymakers made a new promise (average inflation targeting), allowing inflation to run above its target to make up for the time it ran below. Once again, the promise of easy money help creates low-risk perceptions, creating a mindset that there is no alternative to equity investments.

Now policymakers are in a jam, and so too are equity investors.

Never before has it started to raise official rates when the Fed funds rate stood 800 basis points below the current inflation rate. The new promise by the Fed is to get back to a “neutral” policy.

What is the new “neutral” for monetary policy? Is it a fed funds rate equal to the inflation rate, or is the old “neutral,” 200 basis points above the inflation rate. Pick your poison. The Fed has a lot of tightening to do, even if the reported inflation rate falls by half or even two-thirds.

In the late 1990s, policymakers raised 175 basis points to 6.5% official rates.

Higher rates, less liquidity, and the failure of new internet companies and others to live up to the hype triggered an abrupt and sharp decline in equity prices.

With the cyclically adjusted P/E running at near-record highs, equity investors overestimate returns and misprice risk even without a change in Fed policy.

Add a hike of 200 to 300 basis points in official rates and a sharp correction in equity prices of 20% to 30% is not unreasonable.

That estimate does not even include a sharp drop in operating profits as it merely reflects a revaluation of equities based on higher interest rates.

The bottom line is this; even if the Fed miraculously achieves a “soft landing for the economy, which suggests little change in the jobless rate, a “hard landing” appears in store for the equity market.