Welcome to Extreme Investor Network, your go-to source for the latest insights in the world of finance and investments. Today, we are diving into the recent developments surrounding Intel (NASDAQ: INTC) and its ambitious plans for its foundry operations.

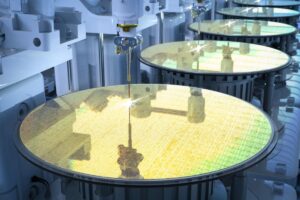

Intel announced that starting in the first quarter of 2024, it will report its foundry operations as a separate business unit. This strategic move is part of Intel’s vision to become a major player in the foundry market by 2030. The company aims to transform its foundry operations into a standalone entity, treating its product divisions as customers and operating with a customer-centric approach.

In its efforts to prepare for this transition, Intel recast its financial statements for the past few years to align with the new reporting structure. Currently, the foundry business is facing challenges, with significant losses reported. However, Intel is optimistic about its future profitability projections, with plans to achieve breakeven by 2027 and a 30% adjusted operating margin by 2030.

While the market initially responded negatively to Intel’s disclosures, there are key factors to consider that could drive rapid profit growth once the foundry operations gain momentum. As Intel’s foundry segment evolves into a separate business unit, it unlocks new opportunities for cost efficiencies and optimized manufacturing processes. By extending the lifespan of its process nodes and serving both internal and external customers, Intel is positioning itself for long-term success in the competitive semiconductor industry.

Intel’s focus on innovation and collaboration with customers will play a crucial role in driving profitability. The company is investing heavily in expanding its manufacturing facilities and launching new process nodes, such as Intel 3, Intel 18A, and Intel 14A, to cater to a diverse range of customer needs. With a strategic approach similar to market leader TSMC, Intel aims to replicate the success of older process nodes and drive sustainable revenue growth over time.

Despite the challenges and skepticism surrounding Intel’s ambitious targets, the company’s shift towards a customer-centric foundry model signals a significant opportunity for profit expansion. As Intel leverages its manufacturing assets more effectively and penetrates the external market, the potential for rapid revenue growth is within reach.

As you consider your investment opportunities, it’s essential to stay informed and explore a diverse range of options. The Motley Fool Stock Advisor team has identified the top 10 stocks for investors to watch, offering valuable insights and expert guidance for building a successful portfolio. With a track record of outperforming the S&P 500 since 2002, the Stock Advisor service provides valuable recommendations for long-term investment success.

Stay tuned to Extreme Investor Network for more exclusive insights and analysis on the latest trends in finance and investments. Investing in the future starts here.