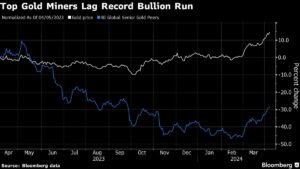

Gold is a hot commodity right now, with prices soaring to record highs nearly every day. However, the world’s biggest gold miners, such as Newmont Corp. and Barrick Gold Corp., have seen their stock prices lagging behind the precious metal’s rally. Despite investing billions to position themselves as top choices for bullion-focused investors, these companies have seen their shares struggle in the market.

At Extreme Investor Network, we believe that understanding the dynamics of the gold market is crucial for investors looking to capitalize on this exciting opportunity. While gold prices have surged by 13% this year, reaching a fresh record high of $2,330.50 per ounce, the performance of gold miners’ stocks has been less impressive. This unexpected divergence has puzzled industry experts, including Peter Grosskopf, chairman of SCP Resources Finance LP.

The recent underperformance of gold producers in the stock market may be temporary, as the industry seems to be undergoing a turnaround. An index of the largest gold producers has increased by 28% since March 1, and companies like Newmont and Barrick have seen their stock prices rise for over a week straight. This positive momentum could signal a shift in investors’ sentiment towards gold mining stocks.

However, challenges remain for gold miners, as inflationary pressures continue to squeeze margins. Companies like Barrick, Newmont, and Agnico Eagle Mines Ltd. are facing rising operating expenses, particularly in North America, where costs for labor and equipment have spiked in recent years. This has raised concerns among shareholders, especially regarding large acquisitions like Newmont’s $15 billion deal for Newcrest Mining Ltd.

As experts in finance, we believe that keeping a close eye on gold producers and their ability to manage costs effectively will be crucial for investors looking to navigate this challenging environment. By staying informed about the latest developments in the gold market and gold mining industry, investors can make well-informed decisions to maximize their returns.

The current rally in gold prices, combined with potential improvements in miners’ cost management, could present a favorable opportunity for investors. As Robert Crayfourd, co-manager of the CQS Natural Resources Growth & Income fund, points out, the easing of inflationary pressures could turn into tailwinds for gold miners, aligning their performance with the spot gold market.

At Extreme Investor Network, we are committed to providing our readers with valuable insights and analysis to help them make informed investment decisions. Stay tuned to our website for the latest updates on the gold market and other investment opportunities that could help you achieve your financial goals.