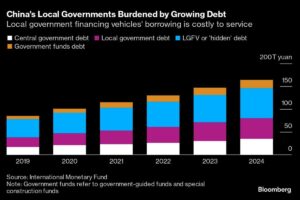

China’s local debt market is currently facing a surge in defaults, catching many investors off guard. What was once thought to have an implicit state guarantee has now turned into a risky investment. Last year, the central government took steps to address the wave of bad debt issued by municipalities’ financing arms by allowing local governments to raise funds through new bonds and providing additional refinancing support from state banks.

Despite these efforts, one segment of the market has continued to struggle. Non-standard products, which are fixed-income investments not publicly traded, have seen a record number of defaults. Analysts estimate the sector to be around $800 billion, and in the first nine months of this year, there were 60 defaults or warnings of repayment risks tied to LGFVs, up 20% from the previous year.

These defaults have had significant consequences for retail investors like Lulu Fang, who lost her life savings in trust products tied to Guizhou province. She, along with many others, faced financial turmoil and uncertainty as they sought repayment on their investments.

The local government financing vehicles (LGFVs) that fund infrastructure projects have been a source of these non-standard products. As projects funded by LGFVs do not always generate revenue, they rely heavily on government support, raising concerns about financial stability.

While publicly traded bonds issued by LGFVs have never defaulted, non-standard products lack transparency and are more difficult to support. This has left investors in these products in a precarious position, with little hope of recovering their investments.

To address the situation, the central government is considering allowing local authorities to issue bonds to refinance off-balance sheet debt. This could potentially provide support for non-standard products, but the outcome remains uncertain.

Despite the high costs associated with non-standard financing, LGFVs continue to pursue these channels due to economic challenges and tightened restrictions on bond sales. Retail investors like Jason Lai have been left disillusioned by their experiences, with little hope of recovering their losses.

As the situation in China’s local debt market continues to evolve, investors are reminded to carefully consider the risks associated with non-standard products and seek guidance to make informed investment decisions. Stay tuned to Extreme Investor Network for more updates on finance and investment news.