At Extreme Investor Network, we are always on the lookout for the latest trends and opportunities in the world of finance. Today, we are diving into the extraordinary rise of gold prices and the key role that China is playing in this market.

Gold has soared to all-time highs above $2,400 an ounce, attracting global attention. One of the driving forces behind this surge is China, the world’s largest producer and consumer of gold. Chinese demand for gold has been relentless, with retail shoppers, fund investors, futures traders, and even the central bank turning to gold as a safe haven asset in times of uncertainty.

In fact, China has overtaken India as the world’s biggest buyer of gold, with record levels of consumption in jewelry, bars, and coins. The country’s demand for gold is expected to continue growing, fueled by limited investment options, a crisis in the property sector, volatile stock markets, and a weakening yuan.

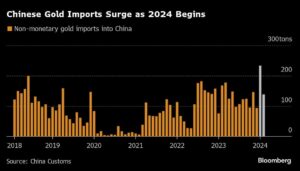

Despite being a major gold producer, China still imports large quantities of the metal, with imports surging in recent years. The People’s Bank of China has been on a gold-buying spree for 17 consecutive months, diversifying its reserves away from the dollar and hedging against currency depreciation.

One of the key factors contributing to China’s robust demand for gold is the Shanghai premium, which reflects the premium that Chinese buyers have to pay over international prices. This premium has been on the rise, indicating strong demand for gold in China even at record prices.

While high prices may dampen some enthusiasm for gold, Chinese consumers have historically supported the market by buying gold during price drops. This has helped establish a floor for the market, even at higher price levels. The sustainability of the rally is bolstered by China’s booming demand for gold, providing comfort to gold buyers worldwide.

In addition to physical gold, investing in gold ETFs is a less frenetic way to participate in the gold market. Chinese investors have been pouring money into gold ETFs, with significant inflows compared to outflows in funds overseas. This trend is expected to continue as investors look to diversify their holdings with commodities.

At Extreme Investor Network, we will continue to monitor the developments in the gold market, particularly the impact of Chinese demand on prices and investment opportunities. Stay tuned for more insights and analysis from our team of experts as we navigate the ever-changing landscape of finance.