The Shifting Landscape of CEO Turnover: What It Means for Investors

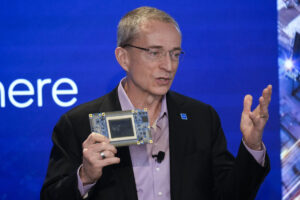

The post-holiday landscape is revealing significant changes on Wall Street—changes that signal a historic shift in corporate leadership dynamics. Recent announcements from major firms like Intel and Stellantis of CEO departures illustrate a growing trend as more chief executives are leaving their posts than ever before. This phenomenon raises critical questions about what’s happening in the corporate world and how it could affect your investments.

Record CEO Departures in 2023

As of October, the data is striking: over 1,800 CEOs have announced their departures this year, according to Challenger, Gray & Christmas, a global outplacement firm. This is the highest number recorded since the firm started tracking these changes in 2002. In fact, CEO exits have surged by 19% compared to the same time last year, setting a new standard for turnover in corporate leadership.

This increase can be attributed to heightened expectations from boards of directors, which are becoming increasingly independent. According to David Kass, a finance professor at the University of Maryland, the pressure on CEOs for performance is mounting, leading to shorter average tenures and a greater likelihood of turnover. Simply put, if a CEO is failing to deliver profit and growth in a favorable market, they are more easily replaced.

The Impact of Stock Market Performance

This turnover is occurring against the backdrop of significant stock market gains. The S&P 500 has seen returns close to 20% in 2023 alone, with projections for even more gains by the end of 2024. Such performance raises the bar for underperforming companies and their leaders. The dominance of a few high-performing stocks—known informally as the "Magnificent Seven"—creates an environment where investors expect continual growth from all companies, not just a select few.

In this context, boards are becoming more aggressive in their approach, often deciding that when a company’s ‘figurative boat is sinking,’ substantial changes in leadership are necessary to right the course. Michael Farr from Hightower Advisors points out that if a company underperforms amidst rising tides for competitors, drastic corrective action is imperative, regardless of whether the departing CEO is directly to blame.

Complex Challenges Facing New CEOs

The challenges that new CEOs face today are not only about improving financial performance. As highlighted by Russell Reynolds, a consulting firm that tracks CEO transitions, there is a growing demand for leaders capable of navigating an increasingly complex macro-business environment. This includes tackling tech transformations, driving sustainability, and managing geopolitical uncertainties.

Starbucks serves as an interesting case study, having faced significant leadership changes in a short period. Michael Conway, the former North America CEO, resigned after just six months, demonstrating the pressures CEOs face in striving to meet performance benchmarks. His predecessor, Laxman Narasimhan, also served a brief stint, underscoring a trend of quick turnover in search of effective leadership.

The Economic Landscape and Its Effects

Rising interest rates, aimed at curbing inflation, add another layer of complexity. CEOs now face additional hurdles in lifting their company’s share prices. The previous climate of low borrowing costs allowed for stock buybacks and investments that typically enhanced shareholder value—options that are severely limited under tighter monetary conditions.

Conclusion: What Investors Should Watch For

For investors, the key takeaway is to remain vigilant. The wave of CEO departures signals the need for reassessment of investment strategies in light of changing leadership dynamics. As companies navigate a competitive landscape with new executives at the helm, they will not only need to meet growth expectations but also respond to broader economic challenges.

At Extreme Investor Network, we are committed to providing in-depth analysis and insights that empower our readers to make informed investment decisions in an ever-evolving financial landscape. Stay with us as we continue to track these changes and explore their implications for your investment portfolio.