Credit Agency Practices Under Trump Era Raise Borrower Risks, Prompt Investor Caution

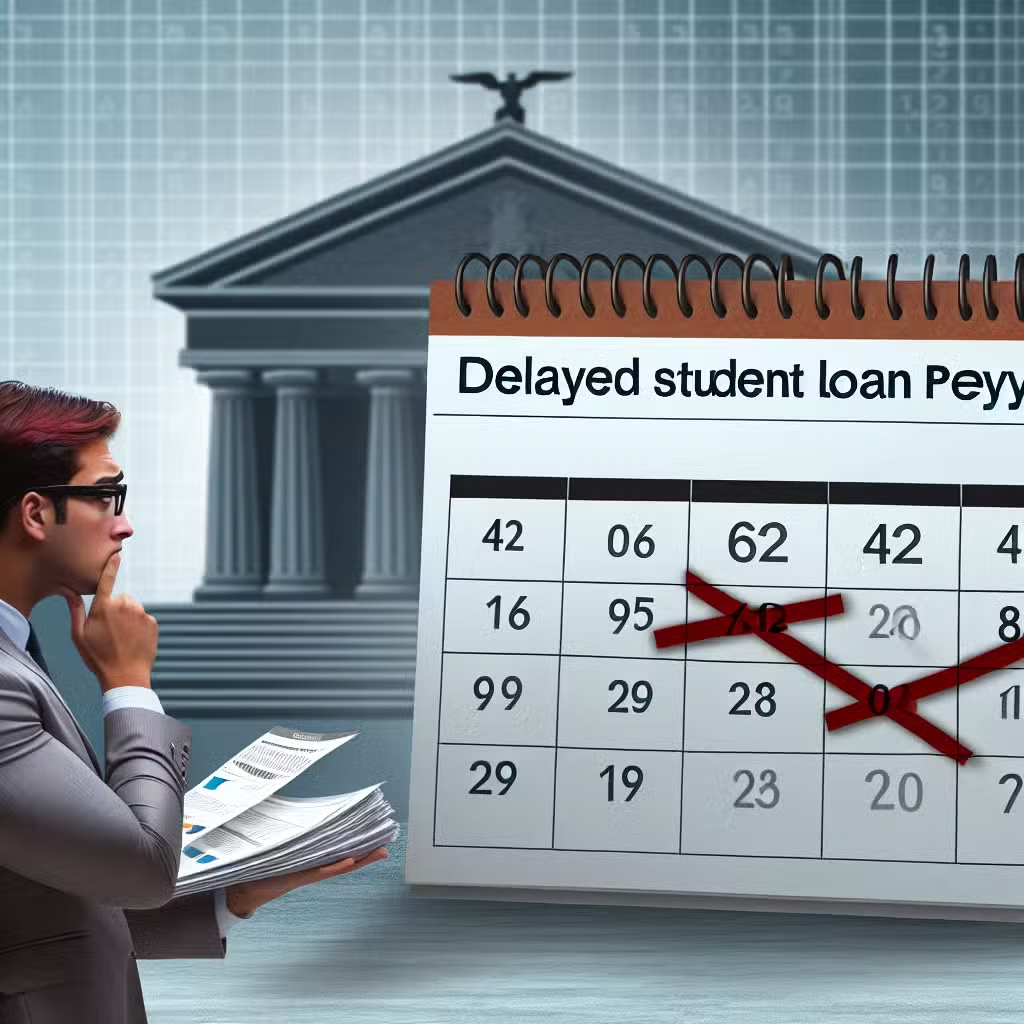

Imagine if your school reported you for skipping class, even though you were locked out of the building and couldn’t get in. That’s what some student loan borrowers say is happening to their credit because of problems with how loans are being handled—and it could affect your wallet, too.

What’s Happening?

Wayne Johnson, a Republican running for Congress in Georgia and a former student loan official, is helping fund a lawsuit against the government and major credit bureaus. The lawsuit claims that millions of student loan borrowers were reported as late on their payments—even when they couldn’t actually make payments or get help from the government.

This matters for investors because credit reports affect everything from borrowing costs to spending. When millions of Americans have lower credit scores, it can ripple through the whole economy—and even hit stocks in banks, credit companies, and consumer sectors.

Why Is This a Big Deal?

- Over 40 million Americans have student loans, according to the Federal Reserve. That’s about 1 in 8 adults. (source)

- More than 5 million borrowers were already in default as of April, and even more are at risk.

- When borrowers are reported as late, their credit scores drop. A recent TransUnion study found that people who defaulted saw their scores fall an average of 63 points. For those with top credit, it could drop as much as 175 points.

Bulls: Reasons to Be Positive

- Possible Reforms: If the lawsuit leads to clearer rules and better reporting, it could help millions fix their credit and get back on track.

- Political Pressure: With so many affected, there’s a big push to improve the system. Better borrower support could mean fewer defaults in the future.

- Economic Boost: If credit scores recover, people can borrow and spend more—good news for banks, lenders, and retailers.

Bears: Reasons to Be Cautious

- More Defaults: With loan collections restarting and staff cuts at the Department of Education, more borrowers may fall behind or stay stuck in default.

- Lower Credit Scores: Damaged credit makes it harder to get loans, rent homes, or even land jobs. This could slow down spending and hurt the economy.

- Legal Uncertainty: Lawsuits and political fights could drag on, keeping the system in limbo and making it harder for businesses to plan.

Historical Context

During the pandemic, collection on student loans was paused for about five years to help borrowers. But now, with those protections gone, collection efforts have ramped up again. In the past, sharp changes like this have sometimes led to spikes in defaults and credit trouble—for example, after the 2008 financial crisis, millions saw their credit scores drop, making it harder for the economy to bounce back (source).

Investor Takeaway

- Watch companies in the credit and lending space—like banks and credit bureaus—for possible bumps as this lawsuit and borrower troubles play out.

- Consumer-facing sectors (like retail and autos) could see changes in demand if millions have lower credit scores and can’t borrow as easily.

- Keep an eye on political developments—student loan policies can shift fast and affect everything from government bonds to private lenders.

- If you hold stocks in education tech or loan servicers, be ready for more headline risk and volatility.

- Diversify: When one part of the economy gets squeezed, having a mix of investments can help protect your portfolio.

For the full original report, see CNBC