Chile’s Central Bank Hits Pause on Interest Rate Cuts Amid Inflation Uncertainty

In a significant announcement, Chile’s central bank has decided to halt its ongoing cycle of interest rate cuts, maintaining the benchmark rate at 5%. This move reflects increasing apprehensions regarding both domestic and international inflation risks, underscoring the complexity of the current economic landscape.

Key Insights from the Decision

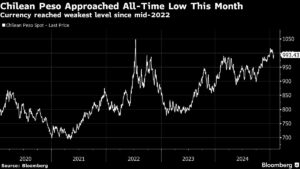

Led by Governor Rosanna Costa, the central bank’s decision was unanimous, aligning with analyst predictions. The recent board statement highlighted crucial factors such as the depreciation of the peso, rising labor costs, and elevated electricity tariffs, all contributing to inflationary pressures. Central bank officials stressed that “inflation risks have increased, which reinforces the need for caution,” marking a shift from previous communications that hinted at possible rate cuts in the near future.

Unlike past announcements, which suggested a downward trajectory for the monetary policy rate, the current statement refrains from indicating specific directional guidance. This ambiguity suggests that policymakers will consider a wide range of macroeconomic factors before making future rate adjustments, emphasizing a vigilant approach towards inflation trends and economic developments.

Economic Context and Market Response

Chile’s central bank is navigating a challenging economic environment where inflation has stubbornly remained above the target rate. The combination of rising wages, increased electricity costs, and a weakened peso has resulted in higher import prices, complicating the inflation picture. Interestingly, while the peso’s depreciation has made imports costlier, there are signs that domestic economic activity is improving, albeit slowly.

Market analysts, including Florencia Ricci from Banchile Inversiones, interpret the central bank’s latest messaging as a clear signal of heightened inflation risks. The removal of phrases that indicated a forthcoming decrease in rates suggests a cautious stance, one that seeks to avoid unintentional consequences in financial markets.

In the wake of this announcement, swap rates on one-year contracts saw an immediate increase, climbing as much as 13.7 basis points—a clear reflection of market sentiment towards cautious monetary policy.

Broader Economic Implications

Chile’s decision on interest rates closely mirrors actions taken by the U.S. Federal Reserve, which is also anticipated to pause its easing cycle. This synchronized approach at the top levels of monetary policy indicates a broader apprehension about maintaining economic stability in an environment of rising global uncertainty. With geopolitical factors, trade tariffs, and shifts in administration in the U.S. contributing to volatility, the global economic landscape remains delicate.

Locally, the inflation rate accelerated to 4.5% in December, with expectations to hover around 5% into early 2025. This trajectory presents ongoing cost-of-living challenges for citizens, even as economic growth appears uneven. Recent data suggests a better-than-expected performance in various sectors, though both bank lending and the labor market continue to show weakness.

Looking ahead, analysts project GDP growth of 2.1% for 2025. Despite encouraging signs from industrial and commercial sectors, the central bank remains vigilant, with Felipe Klein from BNP Paribas pointing out the increased risk of inflation expectations becoming unanchored.

In conclusion, as Chile’s central bank adopts a cautious stance on monetary policy, stakeholders in the financial sector must stay alert to potential shifts in economic dynamics. With ongoing assessments of inflationary pressures and macroeconomic conditions, the decisions taken in Santiago could reverberate through global markets, influencing investment strategies and economic forecasts.

For more unique insights and analysis on global financial trends and investment opportunities, stay tuned to the Extreme Investor Network. We offer cutting-edge perspectives that can help you navigate these complex economic waters.