The European Central Bank (ECB) is expected to introduce another interest-rate cut, signaling a more aggressive approach to monetary easing in the face of economic challenges in the euro zone. ECB President Christine Lagarde is set to address the decision and shed light on the path forward during a press conference following the meeting.

The shift towards monetary easing comes as policymakers react to survey data indicating a contraction in the private-sector economy. Analysts predict that the ECB will continue to lower borrowing costs over the next few months to stimulate economic growth and address lingering inflation pressures.

In addition to the ECB decision, the global economy is gearing up for a week of significant events. The US and Canada will release data on retail sales, factory output, GDP growth, and housing starts, providing insight into the economic momentum in the region.

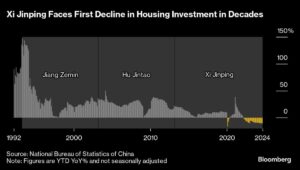

Meanwhile, China remains in the spotlight as it releases key economic data, including industrial output, retail sales, and third-quarter GDP figures. Other central banks in Asia, such as the Monetary Authority of Singapore, Bangko Sentral ng Pilipinas in the Philippines, and the Bank of Japan, are set to make policy statements and decisions that could impact regional markets.

In Europe, the focus will be on the UK, Germany, and Italy, where data on wages, inflation, and retail sales are expected to be released. The UK’s inflation data could show a weakening trend, while Germany faces economic challenges amid a forecasted contraction. Italy is set to announce its budget, and the EU summit will discuss competitiveness and economic issues in the region.

In Africa, the Reserve Bank of South Africa will provide guidance on inflation and interest rates, while Nigeria and Namibia are expected to release inflation and interest rate decisions. In Turkey and Egypt, central banks may hold or adjust rates based on recent inflation trends.

Latin America will see rate decisions in Chile, economic data releases in Peru and Colombia, and surveys of expectations from central banks in Brazil and Colombia. Unemployment rates and GDP-proxy readings will also be closely monitored in the region.

As the global economy faces challenges and uncertainties, investors and policymakers are closely monitoring economic indicators and central bank decisions for signs of recovery and stability. Stay tuned to Extreme Investor Network for the latest updates on the global economy and financial markets.