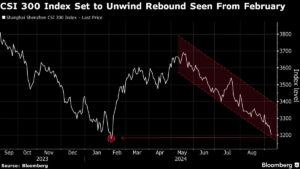

Chinese stocks are on the brink of falling to a five-year low as bearish sentiment continues to grip the market, according to a recent Bloomberg report. This decline comes amid a lack of earnings and economic recovery, with the CSI 300 Index dropping as much as 1.6% on Monday. If the index sees a further decline, it could reach levels not seen since early 2019, highlighting the challenges facing the Chinese economy.

Despite efforts by the government to revive the economy and prop up share prices, the market has been struggling to gain momentum. Short-lived optimism triggers brief rebounds in stocks, only for them to reach new lows shortly after. The piecemeal approach to stimulus has not been effective in restoring confidence, with deflationary pressures, weak consumer demand, and a prolonged property slump contributing to the overall pessimism.

Investment strategist Billy Leung from Global X Management in Sydney notes that the ongoing bearishness in Chinese stocks is largely due to deteriorating short-term dynamics. Without a significant policy shift, particularly in areas like fiscal support for social welfare or housing, this negative sentiment is likely to persist.

Even well-known China bulls like UBS Global Wealth Management, Nomura Holdings Inc., and JPMorgan Chase & Co. have downgraded the country’s equities in recent weeks. Concerns range from a drop in property-led demand to underwhelming stimulus measures and geopolitical tensions ahead of the US elections.

As the equities slump continues, there is a growing consensus among major banks that China may miss its growth target this year. This uncertainty has also impacted global commodity demand, with industrial commodities facing pressure from tepid Chinese demand.

Despite the challenges, some investors see an opportunity in Chinese equities due to their ultra-cheap valuations. The MSCI China Index is trading at less than nine times forward price-to-earnings, offering a potentially attractive risk-reward opportunity for those willing to take a chance.

However, it’s important to note that even the long-term Chinese champions may not be immune to the weak economic backdrop in China. Limited visibility of improvement, combined with domestic policy trends and geopolitical risks, could continue to put pressure on the multiples of Chinese equities structurally.

Ultimately, the performance of Chinese stocks will depend on a variety of factors, including earnings growth and overall economic recovery. As the situation continues to evolve, investors will need to carefully consider their options and stay informed on the latest developments in the Chinese market.

For more exclusive insights and analysis on finance and investing, stay tuned to Extreme Investor Network. Our expert team provides cutting-edge information and in-depth analysis to help you navigate the world of finance with confidence and success.