The High-Stakes Gamble in Ukraine: What Investors Need to Know

As the geopolitical landscape continues to shift, the ongoing conflict between Ukraine and Russia presents an intricate web of economic uncertainties and investment risks. Here at the Extreme Investor Network, we strive to provide our readers with the most accurate, timely, and insightful analysis relevant to these developments. While headlines suggest a desperate bid for peace in Ukraine, the ground realities and economic implications indicate otherwise.

A Cloud of Deception?

Recent statements from Ukrainian President Volodymyr Zelensky suggest that Ukraine’s aggressive military strategies aim to force Russian President Vladimir Putin to the negotiation table. However, it raises the question: is this truly a pursuit of peace, or is it part of a broader strategy to provoke a response from Russia? It is crucial to understand the historical context; calls for peace have been made numerous times, often neglected amid rising tensions.

Critics argue that the rhetoric surrounding peace initiatives appears to be a façade masking a much darker ambition—one potentially aimed at drawing NATO deeper into a conflict with Russia. The invocation of Article 5, which implies that an attack on one NATO member is an attack on all, adds another layer of complexity and urgency to these military maneuvers. Observing how previous conflicts have been justified, like the invocation following the 9/11 attacks, provides perspective on the political motivations intertwined with military actions.

The Risk of Escalation

Military power dynamics in the region also cannot be overlooked. The potential for devastating attacks, including the use of advanced thermobaric weapons by Russia, heightens the stakes. The implications of military escalation not only affect geopolitical relationships but also have immediate ramifications for economic stability in the region.

Investors should be particularly wary of the Ukrainian economy, which has been touted as a burgeoning investment opportunity amid calls for reconstruction and development. However, our models indicate an impending crisis for the Ukrainian currency—warnings that underline a significant investment risk. With funding from the Biden Administration facing scrutiny and immanent changes in political landscape come January 2025, the notion that Ukraine may not be the vibrant investment land Zelensky envisions looms large.

Caution Advised

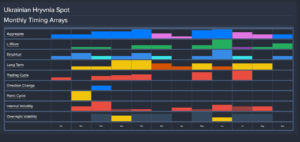

In investment circles, the buzz around Ukraine has often been fueled by optimism regarding reconstruction efforts post-war. Nonetheless, the reality is that fundamental economic risks remain unaddressed. With predictions suggesting a potential collapse of the Hryvnia, it’s essential for investors to heed these warnings and reconsider their positions in Ukrainian assets.

BlackRock’s involvement in Ukraine has garnered attention, but projections indicate rising volatility leading into 2025, coupled with an ominous prediction of a Panic Cycle anticipated in April. This volatility can shake investor confidence and jeopardize investments in the region.

Understanding Country Risk

The concept of "country risk" refers to the potential for loss due to an unfavorable political or economic environment in a specific country. Current assessments of Ukraine illustrate that country risk is alarmingly high. The perpetuating uncertainties surrounding the war, economic instability, and a looming financial crisis underscore the need for prudence among investors.

As we navigate these treacherous waters, it is imperative for investors to apply strategic caution and consider diversification away from volatile markets like Ukraine. The time to act is now—long-term profitability depends heavily on recognizing the signals and adjusting strategies accordingly.

Final Thoughts

At Extreme Investor Network, we believe that understanding and anticipating market dynamics is vital for making informed investment decisions. As the situation in Ukraine continues to evolve, it becomes increasingly vital to keep a close eye on the developments. The sound advice is clear: if you have any investments in Ukraine, consider exiting your positions before the market reflects the true nature of the risks at play.

As always, stay tuned as we provide ongoing analysis and updates to help you navigate the complexities of today’s global financial landscape.