A Game-Changing Meeting? The Future of Tech Stocks in China

As the week unfolds, all eyes are on a potential high-profile meeting between President Xi Jinping and Jack Ma, the e-commerce trailblazer behind Alibaba. The implications of this encounter could serve as a powerful catalyst for the ongoing rally in Chinese stocks, particularly in the tech sector, which has been experiencing a robust resurgence.

A Show of Support for Entrepreneurs

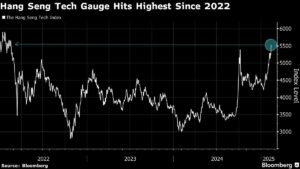

Recently, prominent Chinese entrepreneurs, including Ma, have been invited to meet with the nation’s top leaders. This gathering signifies a critical moment for the private sector in China, especially as the Hang Seng China Enterprises Index continues to climb. After recently reaching its highest level since February 2022, this index was up as much as 1.7% before seeing a slight pullback. Much of this momentum can be traced back to advancements in artificial intelligence, particularly with innovative companies like DeepSeek leading the charge.

According to Bloomberg Intelligence analyst Robert Lea, the endorsement from Xi could send a strong signal of government support for the tech sector, recognized as essential for China’s future economic growth. With the Hang Seng Tech gauge officially entering a bull market, investors are optimistic about the forward trajectory of these equities.

Alibaba and Tencent: Market Movers

Evident in the stock performance of major tech players, the Alibaba Group and Tencent Holdings have been at the forefront of this rally. Alibaba’s Hong Kong-listed shares have surged approximately 60% since January 13, while Tencent’s stock leaped as much as 7.8% on Monday after announcing the integration of DeepSeek’s AI capabilities into WeChat. This spike represents a nearly 40% increase from its January lows.

While some investors view the current rally as overcrowded and risky, Xi’s backing could bolster confidence in the $16 trillion Chinese and Hong Kong stock markets, which have seen consistent gains since mid-January.

Short-Term Gains vs. Structural Shifts

Nenad Dinic, an equity strategist at Bank Julius Baer, cautions that while opportunities abound in the Chinese stock market right now, they may represent short-term trading possibilities rather than fundamental changes. Without additional catalysts—whether through quarterly earnings, liquidity enhancements, or policy shifts—the potential for a market pullback grows increasingly tangible.

The significance of a meeting between Xi and Ma could not be overstated. It was the very actions of the government that led to the halting of Ant Group’s colossal initial public offering, which marked an aggressive regulatory stance. A positive interaction this time around would not only suggest a warming relationship between the government and tech entrepreneurs but could also indicate a broader shift towards encouraging private-sector growth.

A Pivot in Government Stance

Christopher Beddor from Gavekal Dragonomics asserts that having Jack Ma in attendance could symbolically mark the end of a government crackdown that began when Ma had initially sought to expand Ant Group. The optics of Xi encouraging Ma and other tech frontrunners to thrive would convey a stark reversal in government policy, reassessing the vital role of innovation in driving economic productivity.

China’s push for self-reliance in high-tech industries, particularly against the backdrop of rising U.S. sanctions, underscores the urgency for change. As Xi champions "new productive forces," the development of technologies like AI will only accelerate this trajectory.

Attractive Valuations Amid Market Shifts

Interestingly, despite the current excitement, the Hang Seng Tech index is trading at a relatively modest 18.2 times forward earnings, especially when compared to the astronomical valuation of 44.9 times seen just four years ago. Observations from Sandy Pei, a senior portfolio manager at Federated Hermes, reveal that after years of suppressed valuations, Chinese equities are starting to reflect better sentiment due to catalysts like DeepSeek—a trend that’s positively influencing not just technology, but sectors like electric vehicles and healthcare.

As institutional sentiment shifts, even analysts at Goldman Sachs have raised their expectations for MSCI China and CSI 300, forecasting double-digit growth in the near future. The transformative impact of AI in reshaping investor perspectives about Chinese technology could potentially alter economic forecasts altogether.

Conclusion: A Bright Outlook for Investors

In conclusion, the convergence of government support, innovative breakthroughs in technology, and an encouraging market environment paints an optimistic picture for Chinese equities. As the tech sector leads this transformative wave, investors should keep a keen eye on developments arising from key meetings this week—especially the one between Xi and Ma—as they could herald a new era of growth for the Chinese economy.

At Extreme Investor Network, we encourage you to stay informed about these dynamic market changes, as they present compelling opportunities and risks in one of the world’s largest investment landscapes.