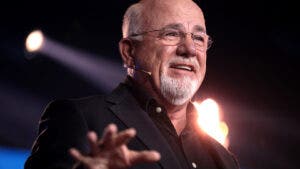

Teachers are often considered society’s unsung heroes, with their modest salaries and dedication to shaping young minds. However, what many people don’t realize is that some teachers are quietly building significant wealth and becoming millionaires. This surprising trend has been brought to light by Dave Ramsey, a renowned voice in personal finance and CEO of Ramsey Solutions.

Ramsey emphasizes that building wealth is not about making a huge income but about smart planning. He famously stated, “You can’t earn your way out of stupidity.” This statement underscores the fact that many millionaires are not high earners but rather individuals who make wise financial decisions.

According to a research project by Ramsey Solutions, the “National Study of Millionaires,” teachers are among the professions most likely to have millionaires. Despite having an average annual salary of $61,690, teachers are finding their way into the millionaires’ club, trailing just behind engineers and accountants.

One key finding from the study is that most millionaires did not come from affluent families, with 79% of them not inheriting their fortune. Instead, they invested wisely, with eight out of ten having a 401(k) retirement account. Interestingly, three-quarters of millionaires did not have high-paying jobs, dispelling the myth that wealth is only attainable for the super-rich.

Ramsey points out that many millionaires are systematic in their approach to finances, working with plans and sticking to them. He highlights the importance of well-planned spending and investing habits, noting that 85% of millionaires use a shopping list, with 28% consistently following it.

In terms of investment options, Ramsey recommends considering certificates of deposit (CDs) with good interest rates and fixed terms, as well as high-yield savings accounts that can yield returns exceeding 4%. He stresses the importance of making your money work for you through smart financial decisions.

Additionally, Ramsey addresses the role of passion in financial outcomes, advising individuals not to choose a job solely based on its paycheck. He believes that doing something you love and are good at can lead to financial success, but it’s not a guarantee. For moderate-income earners like teachers, careful planning and smart investing can lead to a secure financial future.

Ultimately, Ramsey’s insights extend to various professions, including the medical field, where many doctors struggle with debt and delayed investments despite their high wages. By highlighting the financial success of teachers and other moderate-income earners, Ramsey challenges the notion that wealth is exclusively reserved for the wealthy elite.

At Extreme Investor Network, we believe in empowering individuals to make informed financial decisions and build wealth regardless of their income level. Our platform offers valuable resources and personalized guidance to help you achieve your financial goals and secure your future. Join us today and start your journey towards financial success.