The Surge of IonQ: A Quantum Leap or Just Hype?

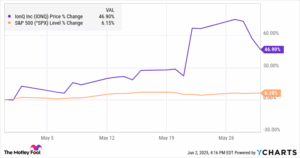

IonQ (NYSE: IONQ), the forerunner in quantum computing technology, saw a staggering 47% increase in its stock value last month. This uptick can be attributed to multiple factors, including favorable mentions in reputable financial circles and optimism in the broader market.

The Nvidia Comparison

In a striking declaration, CEO Niccolo de Masi expressed his bold vision for IonQ, likening it to Nvidia’s dominance in classical computing. This comparison certainly caught the attention of investors but raises questions about sustainability. Nvidia is a powerhouse with reported revenues in billions, while IonQ reported merely $7.6 million in its recent first quarter.

Earnings Report & Acquisitions

IonQ’s first-quarter earnings report aligned with market expectations, and its strategic acquisition of Lightsynq further contributed to investor enthusiasm. The acquisition reflects an aggressive push into quantum technology, positioning IonQ as a leader. However, their GAAP net loss of $32.3 million and an adjusted EBITDA loss of $35.8 million highlight ongoing financial challenges.

Price-to-Sales Ratio Warning

Currently trading at a price-to-sales ratio exceeding 100, IonQ’s stock is a captivating but risky asset. Historically, such high valuations can lead to significant corrections, especially when growth expectations aren’t met. The question investors must ask is whether this stock is buoyed by genuine technological promise or speculative fervor.

Strategic Partnerships

Adding another layer to its narrative, IonQ has signed a memorandum of understanding (MOU) with the Korea Institute of Science and Technology (KISTI). This collaboration could pave the way for groundbreaking advancements in quantum computing, a sector that is increasingly seen as the next technological frontier following AI.

What Lies Ahead?

IonQ is projecting revenues between $75 million and $95 million for the year. However, justifying its current market cap of around $10 billion at that revenue level seems a stretch, especially considering its flat growth reporting. For investors catalyzed by the momentum of quantum technology, a cautious approach is advised.

Consider Alternatives

Before diving in, it’s essential to weigh the broader landscape. The Motley Fool recently highlighted ten stocks with greater potential, leaving IonQ off the list. This could imply that well-informed investors might find more promising avenues elsewhere.

Considering past successes, investments in trendsetter stocks like Netflix and Nvidia at their early stages have yielded remarkable returns. In fact, investing $1,000 in Netflix back in 2004 would be worth over $651,000 today, and Nvidia would have turned that same investment into over $828,000.

The Final Verdict

As IonQ rides the current wave of interest in quantum computing, it’s crucial for potential investors to conduct thorough due diligence. While the allure is significant, so are the risks. Remember, as with every investment, timing and strategy can make all the difference.

In the rapidly evolving landscape of quantum technology, staying informed and making responsible investment choices will set you apart. At Extreme Investor Network, we emphasize not just the latest trends but the wisdom that comes from understanding the underlying fundamentals. Always look before you leap!