Nvidia’s Anticipated Earnings Report: Insights and Analysis from the Extreme Investor Network

As anticipation builds for Nvidia’s (NVDA) upcoming earnings report, the sentiment on Wall Street remains largely optimistic, even amidst recent challenges presented by competitors. The tech giant has become synonymous with artificial intelligence (AI) advancements, leading the charge as global investments in AI infrastructure skyrocket.

Though concerns arose earlier this year regarding the impact of lower-cost alternatives from competitors like China-based DeepSeek, many analysts still foresee Nvidia benefitting significantly from the unprecedented growth in AI demand. Notably, hyperscalers—large players like Amazon (AMZN) and Meta (META)—have communicated aggressive capital expenditure (capex) growth for 2025, reinforcing the ongoing commitment to AI-driven technologies.

AI Investment Forecasts:

Russell Investments’ CIO, Kate El-Hillow, succinctly stated, "Over the coming decades, the investment in AI is happening." This sentiment aligns with broader market trends where, despite some recent hesitance, the overall projection for AI GPU demand remains robust.

However, investors should approach the forthcoming earnings report with a balanced view. Recent data from Yahoo Finance indicates that Nvidia’s earnings per share (EPS) trend has experienced a modest decline over the last month, and analysts have not raised their EPS estimates for Nvidia in over two months.

Nvidia’s Competitive Valuation:

Interestingly, amidst these dynamics, Nvidia is positioned among the more attractively valued AI stocks in the market. With a forward price-to-earnings (P/E) ratio of 32x, Nvidia outshines some of its competitors, such as Broadcom (AVGO) at 35x, Marvell Technology (MRVL) at 41x, and Arm Holdings (ARM) commanding a staggering 76x. This valuation may indicate that despite the competitive landscape, Nvidia’s fundamental strengths warrant its position as a market leader.

Market Perspectives:

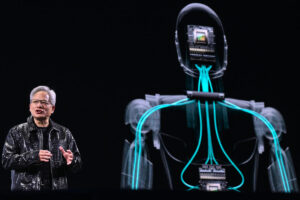

Bill Gates, co-founder of Microsoft (MSFT), offered a candid view on the pressures Nvidia might face in a rapidly evolving tech landscape. He noted, "I wouldn’t want to be Jensen [Nvidia CEO Jensen Huang] necessarily because wow, other people are working on the same things." This acknowledgment of the competitive arena underscores the importance of ongoing innovation and adaptation for Nvidia in maintaining its lead.

Currently, the sentiment within the investment community leading up to Nvidia’s earnings report on February 26 remains constructive, but cautious. Analysts recommend keeping an eye on market reactions post-report, particularly in light of potential headwinds stemming from the transition to the Blackwell architecture and fluctuating demand due to geopolitical factors associated with China.

Future Growth Expectations:

While there may be some downward adjustments for certain projections, such as an 11% reduction in fiscal year 2026 data center revenue to $209 billion, this forecast remains notably above consensus estimates of $184 billion. Most analysts, however, view this as a temporary adjustment, pointing to the strong pipeline of new products and the anticipated momentum in AI investments.

As Nvidia prepares to unveil its latest advancements—a roadmap that includes the pivotal B300 and GB300 products—their strategic position in the AI ecosystem shines brightly. Recent interactions with varied customers reaffirm confidence in Nvidia as a primary platform among hyperscalers, buoyed by the strength of its software ecosystem and a vast development community, placing it firmly ahead of competitors like AMD and AWS.

In conclusion, while the road ahead may present challenges, Nvidia’s existing strengths, solid market positioning, and forward-thinking innovation strategies suggest that the company remains a formidable player on the global tech stage. Investors should closely monitor the upcoming earnings report, as it could set the tone for Nvidia’s trajectory in the fast-evolving AI landscape.

Stay tuned for more updates and insights from the Extreme Investor Network as we continue to dissect market trends and provide unparalleled analysis for the savvy investor.